Life Insurance Awareness Month 2023

We’re committed to providing you with all the information you need to be an informed and savvy consumer, and we wanted to share some of the facts and figures from Life Insurance Awareness Month.

What is Life Insurance Awareness Month?

Life Insurance Awareness Month (LIAM) is a campaign that occurs every year during the month of September. The nonprofit organization, Life Happens, sponsors LIAM—a month-long campaign dedicated to helping consumers take personal financial responsibility through the ownership of life insurance and related products. This is the perfect time to take full advantage of LIAM resources to get educated about life insurance. What better time than now to get started on securing your future.

Get Educated: Statistics and Studies

What is LIMRA’s Insurance Barometer Study?

The purpose of LIMRA’s Insurance Barometer Study is to provide a snapshot of how Americans think about life insurance and how they feel about their own coverage. For each survey, LIMRA interviews roughly 1,200 consumers who have either purchased life insurance or are considering purchasing it. They ask questions about what kinds of coverage people currently have (or don’t have), why they bought it (or didn’t buy it), and where they learned about the product.

LIMRA Insurance Barometer Study results

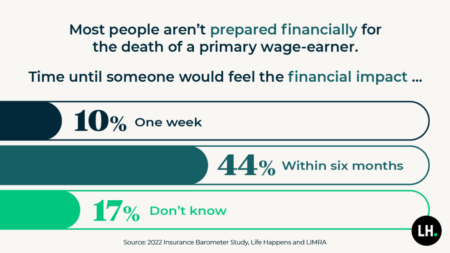

The study found that half of Americans don’t have life insurance and that COVID has made it more likely that they will purchase life insurance within the next year.1 When looking at key groups, interest is highest among Millennials (44%), Black Americans (38%), and Hispanics (37%). The purchase intent for life insurance also reached a record high this year, signaling more people are aware of the product and its need.

Key Market: Millennials

Millennials, ages 24 to 40, are at a time in their life when they need to be thinking about life insurance. They are typically married, have children, and enjoy a sufficient salary with the majority having more than $100,000 in household income.2 Yet more than half of millennials have no life insurance coverage at all, putting their loved ones at risk of financial hardship should they die unexpectedly. Misconceptions about insurance often deter them from purchasing the coverage they say they need.

The 2022 Insurance Barometer Study finds that more than one-third of millennials say they don’t own life insurance because it is too expensive.3 In reality, the cost of life insurance could end up being less than a cup of coffee a day. In general young, healthy adults are most likely to not only qualify for coverage but also be able to secure the most affordable rates.

“Nearly half (47%) of millennials (34 million adults) say they need (or need more) life insurance.” – LIMRA Barometer Study 2022

This is where education about life insurance and the assistance of an insurance agent or financial professional comes in. They will explain how to select the right type of coverage for your circumstances and discuss options that can provide protection for your loved ones should you pass away.

Benefits of Life Insurance

Life insurance is an essential part of any financial plan. While life insurance provides security and protection for your loved ones when you are no longer here, it can also provide a reservoir of cash in some policies. Strategically planning for your future with life insurance ensures that you will have a well-rounded plan for years to come. If plans change, you can buy another policy or cancel an old one.

Protection

Wealth Creation

Savings

Tax Savings

Who needs life insurance?

Life insurance is an essential part of any financial plan. While life insurance provides security and protection for your loved ones when you are no longer here, it can also provide a reservoir of cash in some policies. Strategically planning for your future with life insurance ensures that you will have a well-rounded plan for years to come. If plans change, you can buy another policy or cancel an old one.

Living life with life insurance means that you can fully enjoy your time here without worrying about the what-ifs in life, and by providing peace of mind with life insurance, the burden of the unknowns is relieved from your shoulders.

- Homeowners

First-time homeowners carry a lot of debt. If you were to pass away while still paying for your mortgage, how would your loved ones pay for the additional cost of owning a house? Life insurance provides protection from life’s unknowns and big what if’s. Instead of your family struggling to pay for your funeral payments, credit card debt, car payments, and mortgage, the insurance company will provide a benefit amount upon your passing which can pay for the entire amount of the house or condo and may even cover your additional debts.

- Newlyweds

Married couples and life partners are likely to both work and contribute to the household income. What happens when one person passes away and the household income decreases, but the same amount of bills need to be paid, plus funeral costs? The survivor is left with the burden of the loss of a loved one and the harsh reality of increased financial obligations. A life insurance policy’s death benefit can be spent in any way the beneficiary likes. Proceeds from a life insurance policy would help the surviving partner maintain their lifestyle by helping to pay bills and debt including mortgage payments, car payments, student loans, and credit card debt.

- New Parents

Taking on the new role of parenting, or adding an extra bundle of joy in your life can be both challenging and rewarding. Having a child can also be quite expensive with the typical American family spending $233,000+ raising a child from birth to age 18. For a middle-income family, housing accounts for 29% of costs, 18% for food, 16% for child care/education, according to the USDA.

Life insurance provides an income should one, or both parents pass away. The life insurance benefit can be used for costs of living including food, housing, child care, and education. If you are a single parent, the life insurance benefit is a financial lifeline for your child should you pass away.

See this Bankrate guide that covers which financial expenses soon-to-be parents can expect. It includes a breakdown of the different costs to consider when raising a child.

- Highly-paid employees

Many employers now offer group life insurance with a few thousand dollars of benefit to cover a small funeral cost, sometimes more. However, this is often not enough coverage especially if you have a family. If you are looking to move jobs, your group life insurance coverage will likely end creating a gap in coverage for you and your loved ones. Having your own individual life insurance policy means you won’t have a gap in coverage when you switch jobs.

If you’re starting your own business, a “key person” insurance coverage will help to protect your business by providing a benefit to replace the lost income and pay for business expenses in case of death or disability. Valued partners and employees have an enormous impact on your business both positively, but also negatively if they cannot perform their job. With a “key person” coverage you can use the benefit to buy out a partner without depleting company cash reserves, or use the cash to pay for expenses and buy time to fill in the gap.

- Individuals Looking Towards Retirement

Life insurance is important in creating a well-structured and well-rounded retirement plan. Permanent life insurance policies provide a reservoir of cash that you can use during retirement through the cash value component. Life insurance is also used for estate planning and may help your beneficiaries pay taxes and legal fees. Consult with your financial advisor on the best plan for your retirement needs.

- Caregivers

The aging population is living longer, and many people in the United States rely on family members to care for them. This puts an enormous financial and emotional burden on loved ones as they try to cope with their ailing relatives. If you’re providing care for an aging relative, a life insurance policy is essential in making sure you have a backup plan to protect their continuity of care if you pass away.

- Divorcees

Ending a relationship is a good time to reevaluate your existing life insurance before a divorce is finalized. If your current life insurance coverage lists an ex as a beneficiary, consider excluding them from your list. Don’t forget to review your beneficiaries after splitting up. In addition, consider purchasing your own life insurance policy, or adding a new one.