Retirement Income

Annuities: A Path to Financial Security

In today’s uncertain financial landscape, planning for a secure retirement has become increasingly vital. One powerful tool that can help individuals achieve financial stability during their golden years is an annuity.

What Is An Annuity?

Annuities are insurance products designed to provide a reliable stream of income during retirement. They offer a unique combination of insurance and investment elements. By depositing funds into an annuity contract, you create a financial vehicle that can grow tax-deferred and ultimately provide you with a regular income payout.

Benefits of an Annuity

-

Guaranteed Income for Life: One of the standout features of annuities is their ability to provide a guaranteed income stream for life. This means that, regardless of market fluctuations, you can count on a steady paycheck during retirement. This predictable cash flow acts as a safety net, helping you meet your daily expenses, cover healthcare costs, and maintain your desired standard of living.

-

Accumulation and Growth: Annuities offer the advantage of tax-deferred growth. This means that the earnings on your annuity investment can compound over time without being subject to immediate taxation. As a result, your funds have the potential to grow more efficiently compared to taxable investment options. This tax advantage can significantly contribute to the growth of your retirement savings.

-

Flexibility and Customization: Annuities come in various types, allowing you to tailor your annuity strategy to fit your unique needs and goals. Fixed annuities provide a guaranteed interest rate for a specified period, ensuring a stable income stream. Variable annuities offer the opportunity to invest in a selection of investment options, providing potential market-driven growth. Indexed annuities combine elements of both, offering the potential for growth based on market performance while protecting against downside risk. Working closely with a financial advisor, you can determine the most suitable annuity type based on your risk tolerance and retirement objectives.

-

Death Benefit and Legacy Planning: Annuities offer features that allow you to leave a financial legacy for your loved ones. Upon your passing, the remaining value of your annuity can be passed on to your designated beneficiaries. This benefit ensures that your assets are efficiently transferred, potentially bypassing probate and minimizing estate taxes. By incorporating annuities into your estate planning, you can leave a lasting financial impact for future generations.

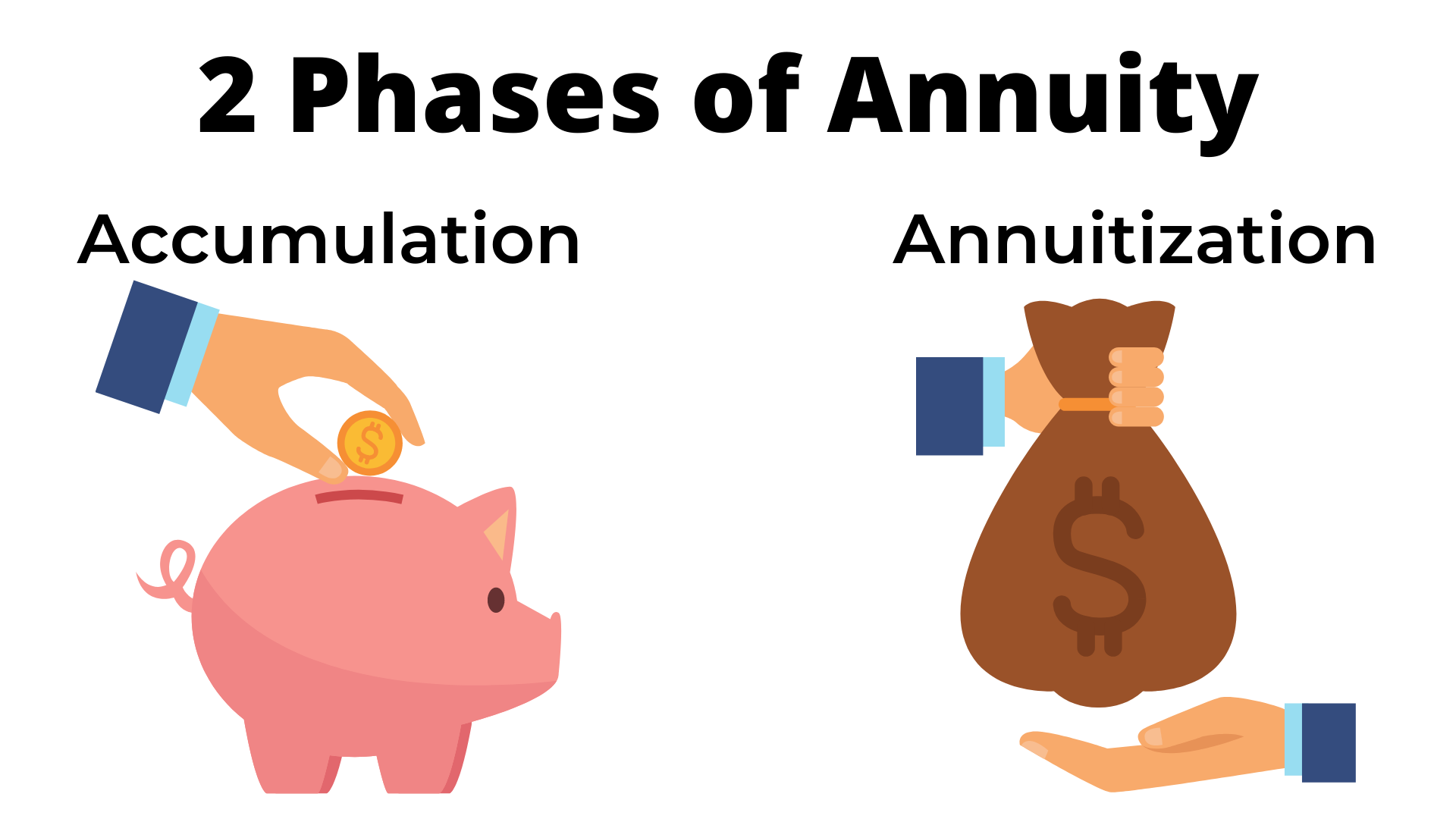

What is Accumulation?

Annuities are divided into two phases. The Accumulation phase occurs while you are still working and able to fund the annuity. Depending on when you buy your annuity, this phase could be very short or last several years and even decades until you retire.

What is Annuitization?

The Annuitization phase begins generally in retirement or an agreed-upon year. In this phase, you can opt to receive the value of your annuity in a lump sum or monthly payments. Many people choose monthly payouts in order to guarantee that money will be coming in long after they’ve stopped earning income from their job.

In short, during annuitization you receive the income from your annuity payments, whilst accumulation occurs when your money remains untouched.

Unveiling the Mechanics of Annuities: Building a Solid Financial Bridge for Your Retirement

Imagine your retirement as a sturdy bridge that connects your working years to a fulfilling future. Annuities serve as the foundation of this bridge, providing a reliable structure that supports your financial journey. Let’s embark on a creative exploration of how annuities work, using metaphors to illustrate their mechanics and benefits.

-

Annuities as Financial Pillars: Think of annuities as the sturdy pillars that uphold your financial bridge. When you contribute funds to an annuity, you’re essentially laying the foundation for a strong and resilient structure. These pillars, representing your investment, grow over time, providing a solid base for future income generation.

- The Growth Engine – Compound Interest: Within the annuity structure lies a powerful engine known as compound interest. This engine is like a well-tuned motor, working diligently to grow your investment. Just as a motor powers a vehicle forward, compound interest propels your annuity’s value higher over time. It allows your initial investment, as well as any accumulated earnings, to grow exponentially, gradually building the financial strength of your retirement plan.

-

Streams of Income – Nurturing the Bridge: As your financial bridge takes shape, it requires streams of income to sustain it. Annuities, acting as nourishing tributaries, provide a reliable flow of income throughout your retirement years. These streams are designed to keep your bridge sturdy and secure, allowing you to traverse the path of retirement with confidence.

- The Versatility of Bridge Materials – Annuity Types: Just as bridges are constructed using different materials, annuities come in various types to suit your unique needs. Fixed annuities are like a solid concrete foundation, offering stable and predictable income. Variable annuities resemble versatile steel structures, allowing you to invest in a range of options for potential growth. Indexed annuities blend the reliability of concrete with the flexibility of steel, providing an opportunity to participate in market growth while protecting against potential downturns. By selecting the right annuity type, you can customize your bridge to match your financial preferences and retirement aspirations.

- Weathering the Storms – Longevity Protection: Retirement is a journey filled with unpredictable weather conditions. Annuities act as weather-resistant elements, safeguarding your financial well-being against life’s unexpected storms. With annuities, you can create a shelter, protecting your income from the winds of market volatility and the downpour of longevity risk. They offer the reassurance of a sturdy roof, ensuring that your financial bridge remains intact, come rain or shine.

- Handing Down a Strong Legacy: Your financial bridge is not only for your benefit but can leave a lasting legacy for generations to come. Annuities provide an opportunity to construct a legacy by designating beneficiaries. As you approach the end of your journey, the remaining value of your annuity can be passed down to loved ones, just as the bridge endures, connecting future generations to financial security.

As you envision your retirement as a well-constructed bridge, annuities become the essential pillars that support your financial journey. With the power of compound interest, reliable income streams, versatility in annuity types, longevity protection, and the potential to leave a lasting legacy, annuities play a vital role in securing your financial future. Consult with a knowledgeable financial advisor to lay the groundwork for your financial bridge using annuities, ensuring that your retirement journey is built on a solid and resilient foundation.

Discover more insights and connect with our team of experienced advisors. Together, we will design a financial bridge that spans the years of retirement, providing strength, stability, and the confidence to embrace the future with open arms.

Steps to Getting An Annuity

Determine How Much Money You Want to Receive in Retirement

Spending time with a member of our Occidental team or a financial advisor can help you determine how much money you want available to yourself in retirement. Annuities can be funded to provide some or all of your financial needs as you live your golden years.

Determine the Type of Annuity You Want

There are 5 types of annuities that determine the type of investment growth possible with your money. A Fixed annuity provides a guaranteed rate of return during the Accumulation phase and is the lowest risk, whereas an Equity-indexed annuity tracks with popular stock indices such as the Dow Jones or S&P 500 and offers greater potential growth and greater investment risk. There are other options available that we will discuss when we speak with you.

Compare and Decide

We want you to feel secure about your eventual retirement. Our team can go over all of the benefits and possibilities of the various annuity solutions available in the market today. We will go over your retirement plans and help you pick an annuity that works for you. We have been serving Hawaii for nearly 90 years and look forward to helping you live your best retirement.