Life Insurance Awareness Month 2022: Why Participate in LIAM?

As an insurance agent, we know how important it is to stay informed about the latest trends in the insurance industry. And since we’re committed to providing you with all the information you need to be an informed and savvy agent, we wanted to share some of the facts and figures from Life Insurance Awareness Month.

What is Life Insurance Awareness Month?

Life Insurance Awareness Month (LIAM) is a campaign that occurs every year during the month of September. The nonprofit organization, Life Happens, sponsors LIAM—a month-long campaign dedicated to helping consumers take personal financial responsibility through the ownership of life insurance and related products. As a life insurance agent, this is the perfect time to take full advantage of LIAM resources to spread the important message about life insurance to your existing clients and launch marketing campaigns aimed at new prospects.

As a life insurance agent, you’re a key player in spreading the word about the importance of life insurance to your clients and prospects.

What are the LIMRA Insurance Barometer Study results?

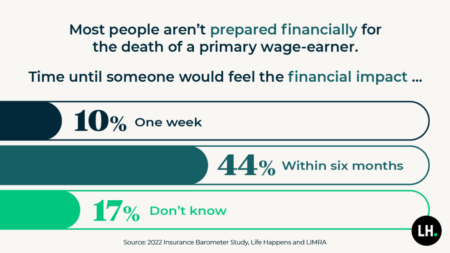

The study found that half of Americans don’t have life insurance and that COVID has made it more likely that they will purchase life insurance within the next year.1 When looking at key groups, interest is highest among Millennials (44%), Black Americans (38%) and Hispanics (37%). The purchase intent for life insurance also reached a record high this year, signaling more people are aware of the product and need.

The purpose of LIMRA’s Insurance Barometer Study is to provide a snapshot of how Americans think about life insurance and how they feel about their own coverage. For each survey, LIMRA interviews roughly 1,200 consumers who have either purchased life insurance or are considering purchasing it. They ask questions about what kinds of coverage people currently have (or don’t have), why they bought it (or didn’t buy it), and where they learned about the product.

KEY MARKET: MILLENNIALS

Millennials, ages 24 to 40, are at a time in their life when they need to be thinking about life insurance. They are typically married, have children and enjoy a sufficient salary with majority having more than $100,000 in household income.2 Yet more than half of millennials have no life insurance coverage at all, putting their loved ones at risk of financial hardship should they die unexpectedly. Misconceptions about insurance often deter them from purchasing the coverage they say they need.

The 2022 Insurance Barometer Study finds that more than one third of millennials say they don’t own life insurance because it is too expensive.3 But in general young, healthy adults are most likely to not only qualify for coverage but also be able to secure the most affordable rates.

Millennials represent the largest market opportunity for our industry with half saying they need life insurance. This is where insurance agents come in and explain how to select the right type of coverage for their circumstances and discussing options can provide additional protection for their loved ones.

Making the Most of Life Insurance Awareness Month

Every year, we’ll gather marketing resources and materials from industry leaders to help you make the most of Life Insurance Awareness Month. Use the tools and resources on this page to access hundreds of email templates, social media posts, videos, websites, and more!

Marketing Tools and Carrier Resources

Last updated: 9/19/2022 at 1:40 pm

-

Copy and paste these client approved emails that promote the quiz as a first step to a more productive conversation about life insurance.