Planning for the Future: Understanding the Importance of Life Insurance

In a world of uncertainties, planning for the future is key. Life throws unexpected challenges our way, and securing financial well-being protects loved ones. A crucial aspect of future planning is understanding the significance of insurance; specifically life insurance.

We will delve into the importance of life insurance and its role in comprehensive financial planning for the future.

Table of Contents

Why Life Insurance Matters

Life insurance is often one of those topics that we tend to push to the back of our minds, especially when we’re young and healthy. It’s easy to think that we have all the time in the world to worry about it later. However, understanding the importance of life insurance is crucial for securing not only our own future but also the well-being of our loved ones. While the thought of mortality may seem daunting, addressing it head-on through life insurance can bring peace of mind knowing that your family will be taken care of financially.

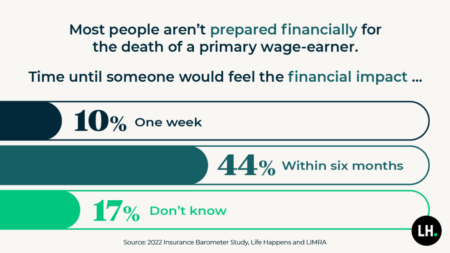

So, why does life insurance matter? Consider this: if something were to happen to you, would your family be able to maintain their current standard of living? Would they be able to cover expenses such as mortgage payments, tuition fees, or everyday living costs? Life insurance ensures that they can.

The Benefits of Life Insurance

Beyond providing for your family’s immediate needs, life insurance offers a myriad of benefits, tailored to suit various life stages and financial goals:

Income Replacement

Life insurance replaces lost income, ensuring your loved ones can continue to meet their day-to-day expenses and long-term financial goals.

Estate Planning

Life insurance facilitates the smooth transfer of assets to your beneficiaries, helping to minimize estate taxes and legal complexities.

Debt Repayment

It can be used to pay off outstanding debts, including mortgages, loans, and credit card balances, relieving your family of financial burdens.

Business Continuity

For business owners, life insurance can be instrumental in funding buy-sell agreements, providing liquidity for business expenses, and safeguarding the company’s future.

Benefits Beyond the Basics

Beyond its primary function of providing a death benefit, life insurance offers a myriad of benefits that extend to both personal and professional realms. For instance, it can serve as a valuable tool for business planning.

Entrepreneurs and business owners can utilize life insurance to fund buy-sell agreements, ensuring a smooth transition of ownership in the event of a partner’s death. Additionally, it can be used to provide key employees with executive benefits, such as supplemental retirement income or incentives to retain top talent.

Moreover, life insurance can be structured to accumulate cash value over time, offering a source of tax-deferred savings that can be accessed during your lifetime for various purposes, such as supplementing retirement income or covering unexpected expenses.

Understanding Your Options

When it comes to life insurance, there’s no one-size-fits-all solution. It’s essential to understand the various types of policies available and choose one that aligns with your unique needs and goals. Life insurance comes in various forms, each serving distinct purposes:

Term Life Insurance: Provides coverage for a specified period, typically ranging from 10 to 30 years, and is well-suited for those seeking affordable, temporary protection.

Permanent Life Insurance: Provides lifelong coverage and includes options such as whole life, universal life, and variable life insurance. These policies offer not only death benefit options, but also cash value accumulation and flexibility in premium payments.

- Whole Life Insurance: Offers lifelong coverage with a cash value component, serving as a vehicle for long-term savings and investment.

- Universal Life Insurance: Combines the flexibility of term insurance with a cash value component, allowing for adjustable premiums and death benefits.

- Variable Life Insurance: Allows policyholders to invest in a range of investment options, offering the potential for higher returns but also greater risk.

Secure Your Tomorrow Today

In essence, life insurance is not just about preparing for the inevitable; it’s about empowering you to live life to the fullest, knowing that your loved ones are protected and your financial goals are within reach. Understanding the importance of life insurance is key to securing your future. Take the first step today, and invest in the peace of mind that comes with knowing you’ve planned for tomorrow.