Life Insurance Guide to Policies and Companies

Choosing the type of life insurance can be a little tricky. For more information beyond our guide, we suggest inquiring with your trusted insurance or finance professional.

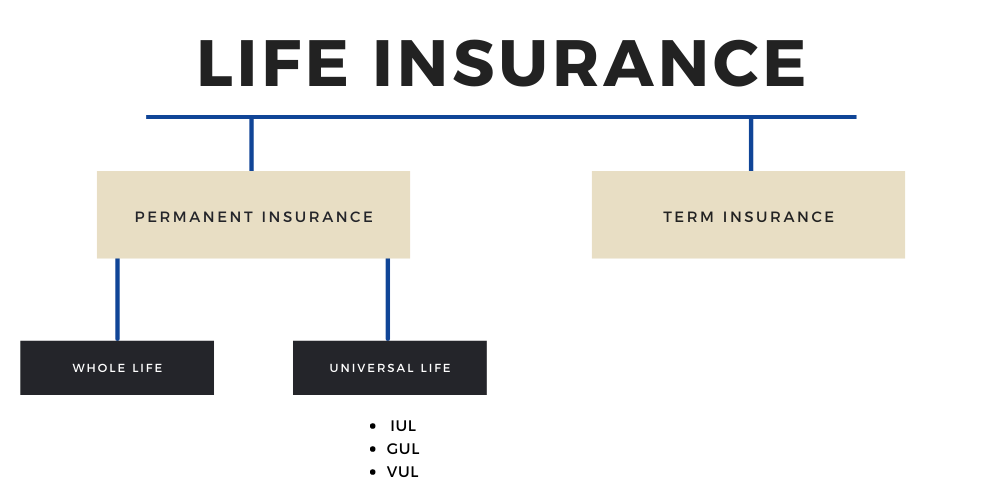

Types of Life Insurance

Term Insurance

A term insurance policy typically provides the greatest benefit amount for the least premiums making it the most affordable option of life insurance. Term insurance provides coverage for a set amount of years (typically 5 to 30 years, varying depending on the insurance company you purchase from).

A benefit of term insurance is knowing how long your coverage will last. For example, a 30-year coverage can be used for your mortgage years making it both a reasonable and sound plan.

Permanent Insurance

Permanent life insurance is a smart addition to any financial plan for people who want more ways to protect their family, minimize their taxes and grow their money over time.

Unlike term insurance, permanent life insurance helps you live more for today by protecting your family for your entire life, while adapting throughout your life to provide tax-advantaged access to your cash when you need it most.

Permanent insurance has cash value with the potential to grow over time with tax-deferred growth.

TAX BENEFITS OF PERMANENT LIFE INSURANCE

While 401(k)s and IRAs offer tax benefits, they have income taxes on the money you pass along.

Permanent life insurance allows you to keep more of your money by helping to minimize your taxes, and generally offering no income taxes on any money you pass along to help give you more control over your and your family’s financial future.

The Best Insurance Carriers

The life insurance carrier is the company that you are paying to protect your family, so it’s important to make sure they have a good reputation and are financially stable. There are several types of life insurance carriers and each type offers different products. So, it is important to find the carrier that fits your needs and budget.

Life insurance is one of the most important financial decisions you will make in life. While the type of life insurance carrier may be less important than the details specific to your situation, a knowledgeable agent can help sift through the small details and get you the best coverage for you. You can also view the best carriers by the type of policy and need, based on Investopedia.

Top Rated Companies to Compare

Who needs life insurance?

Life insurance is an essential part of any financial plan. While life insurance provides security and protection for your loved ones when you are no longer here, it can also provide a reservoir of cash in some policies. Strategically planning for your future with life insurance ensures that you will have a well-rounded plan for years to come. If plans change, you can buy another policy or cancel an old one.

Living life with life insurance means that you can fully enjoy your time here without worrying about the what-ifs in life, and by providing peace of mind with life insurance, the burden of the unknowns is relieved from your shoulders.

- Homeowners

First-time homeowners carry a lot of debt. If you were to pass away while still paying for your mortgage, how would your loved ones pay for the additional cost of owning a house? Life insurance provides protection from life’s unknowns and big what if’s. Instead of your family struggling to pay for your funeral payments, credit card debt, car payments, and mortgage, the insurance company will provide a benefit amount upon your passing which can pay for the entire amount of the house or condo and may even cover your additional debts.

- Newlyweds

Married couples and life partners are likely to both work and contribute to the household income. What happens when one person passes away and the household income decreases, but the same amount of bills need to be paid, plus funeral costs? The survivor is left with the burden of the loss of a loved one and the harsh reality of increased financial obligations. A life insurance policy’s death benefit can be spent in any way the beneficiary likes. Proceeds from a life insurance policy would help the surviving partner maintain their lifestyle by helping to pay bills and debt including mortgage payments, car payments, student loans, and credit card debt.

- New Parents

Taking on the new role of parenting, or adding an extra bundle of joy in your life can be both challenging and rewarding. Having a child can also be quite expensive with the typical American family spending $233,000+ raising a child from birth to age 18. For a middle-income family, housing accounts for 29% of costs, 18% for food, 16% for child care/education, according to the USDA.

Life insurance provides an income should one, or both parents pass away. The life insurance benefit can be used for costs of living including food, housing, child care, and education. If you are a single parent, the life insurance benefit is a financial lifeline for your child should you pass away.

See this Bankrate guide that covers which financial expenses soon-to-be parents can expect. It includes a breakdown of the different costs to consider when raising a child.

- Highly-paid employees

Many employers now offer group life insurance with a few thousand dollars of benefit to cover a small funeral cost, sometimes more. However, this is often not enough coverage especially if you have a family. If you are looking to move jobs, your group life insurance coverage will likely end creating a gap in coverage for you and your loved ones. Having your own individual life insurance policy means you won’t have a gap in coverage when you switch jobs.

If you’re starting your own business, a “key person” insurance coverage will help to protect your business by providing a benefit to replace the lost income and pay for business expenses in case of death or disability. Valued partners and employees have an enormous impact on your business both positively, but also negatively if they cannot perform their job. With a “key person” coverage you can use the benefit to buy out a partner without depleting company cash reserves, or use the cash to pay for expenses and buy time to fill in the gap.

- Individuals Looking Towards Retirement

Life insurance is important in creating a well-structured and well-rounded retirement plan. Permanent life insurance policies provide a reservoir of cash that you can use during retirement through the cash value component. Life insurance is also used for estate planning and may help your beneficiaries pay taxes and legal fees. Consult with your financial advisor on the best plan for your retirement needs.

- Caregivers

The aging population is living longer, and many people in the United States rely on family members to care for them. This puts an enormous financial and emotional burden on loved ones as they try to cope with their ailing relatives. If you’re providing care for an aging relative, a life insurance policy is essential in making sure you have a backup plan to protect their continuity of care if you pass away.

- Divorcees

Ending a relationship is a good time to reevaluate your existing life insurance before a divorce is finalized. If your current life insurance coverage lists an ex as a beneficiary, consider excluding them from your list. Don’t forget to review your beneficiaries after splitting up. In addition, consider purchasing your own life insurance policy, or adding a new one.

How life insurance works

A life insurance policy is a contract between the insurance company and the insured. If the insured passes away within the contract period, the insurance company will pay money, death benefit, to your family. Life insurance is an integral part of sound financial planning.

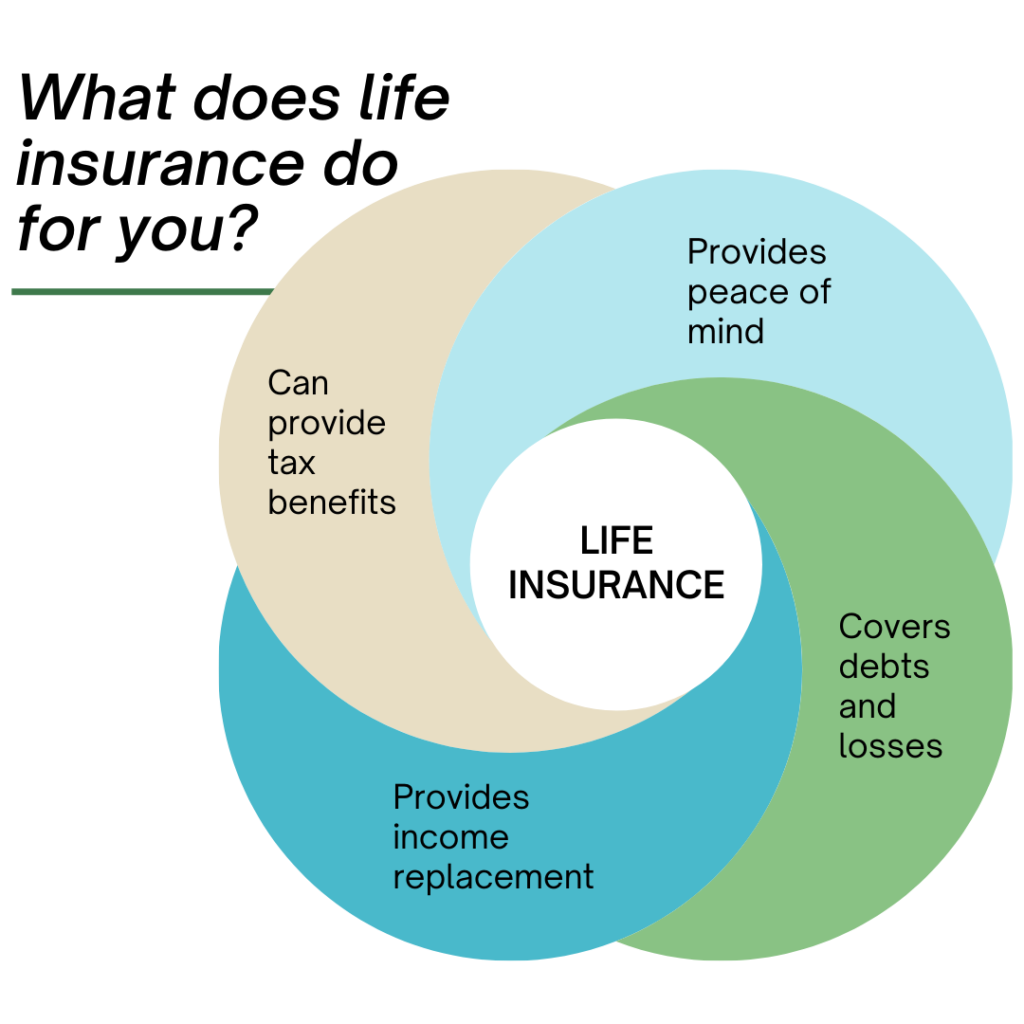

What does life insurance do for you?

- Provides income replacement

- Covers debt and losses

- Can provide tax benefits

- Fund a college education

- Provides peace of mind to you and your loved ones

- Rounds out your retirement plan

Considerations for life insurance

COVID-19 and the Life Insurance Industry

Over the past couple of years, our industry has utilized electronic tools as a proper way to do business. With e-Application processes, expedited underwriting, and the option to get a policy without bloodwork or labs, purchasing life insurance online has never been more efficient and easy. 44% of the population would prefer to get their life insurance quotes online, and 36% prefer to purchase online. With simplified underwriting, you can skip the entire underwriting process — that means no exams, bloodwork, or medical records for qualified individuals. Use our 3 step process and get the coverage you need without the hassle of full underwriting.

COVID-19 has caused people to become more aware of themselves and their loved ones, their mortality, and the long-term retirement risks that they carry. Specifically, life insurance purchases skyrocketed in 2020 within the younger age groups, ages 0-59. However, 80% of millennials say they have limited knowledge of insurance.