Permanent Insurance

Choosing the type of life insurance you need is like picking a new phone. Life insurance policies have many different bells and whistles, each with its own set of unique features.

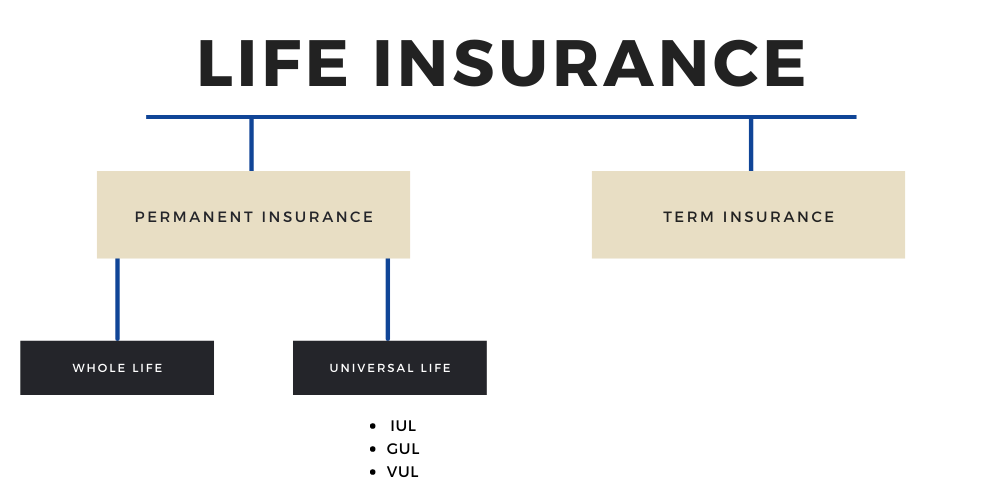

As an overview, there are two main brands of life insurance: Permanent and Term. Permanent insurance is the oldest type of life insurance and is an umbrella term for life insurance policies that do not expire — think of it as the Bell Telephone, the oldest telephone in the world. Under permanent insurance, there are two main types: whole life and universal life. Permanent insurance offers both a death benefit and cash value.

What is Whole Life?

A whole life permanent policy is the most common type of insurance and is meant to provide protection throughout your lifetime. A key feature of a whole life permanent policy is the ability for the policy to build cash value, which can be used however you want. The cash value is guaranteed to grow based on a calculated amount based by the insurance company, such as 3% interest per year. In general, whole life policies are the least risky since cash value accumulation is guaranteed.

What is Universal Life?

Universal life insurance is increasing in popularity and is more flexible than a whole life policy. Universal life insurance policies provide flexibility but can be confusing at times; however, the benefits are impressive. It allows you to adjust your premium payments and death benefit amount. Universal life insurance offers the ability for the policy to build cash value — this cash value is based on market index performance, such as the S&P 500. The cash value accumulation is not guaranteed.

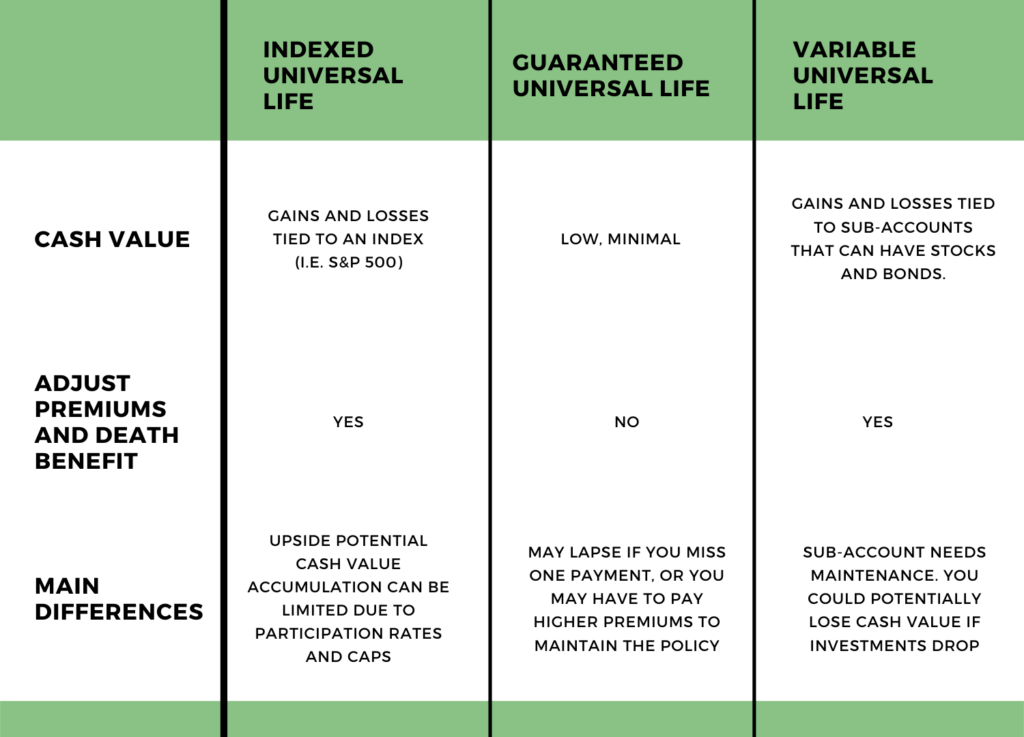

Types of Universal Life Insurance

Under the universal life insurance branch there is Indexed Universal Life, Guaranteed Universal Life, and Variable Universal Life.