Resources

Long-Term Care Awareness Month

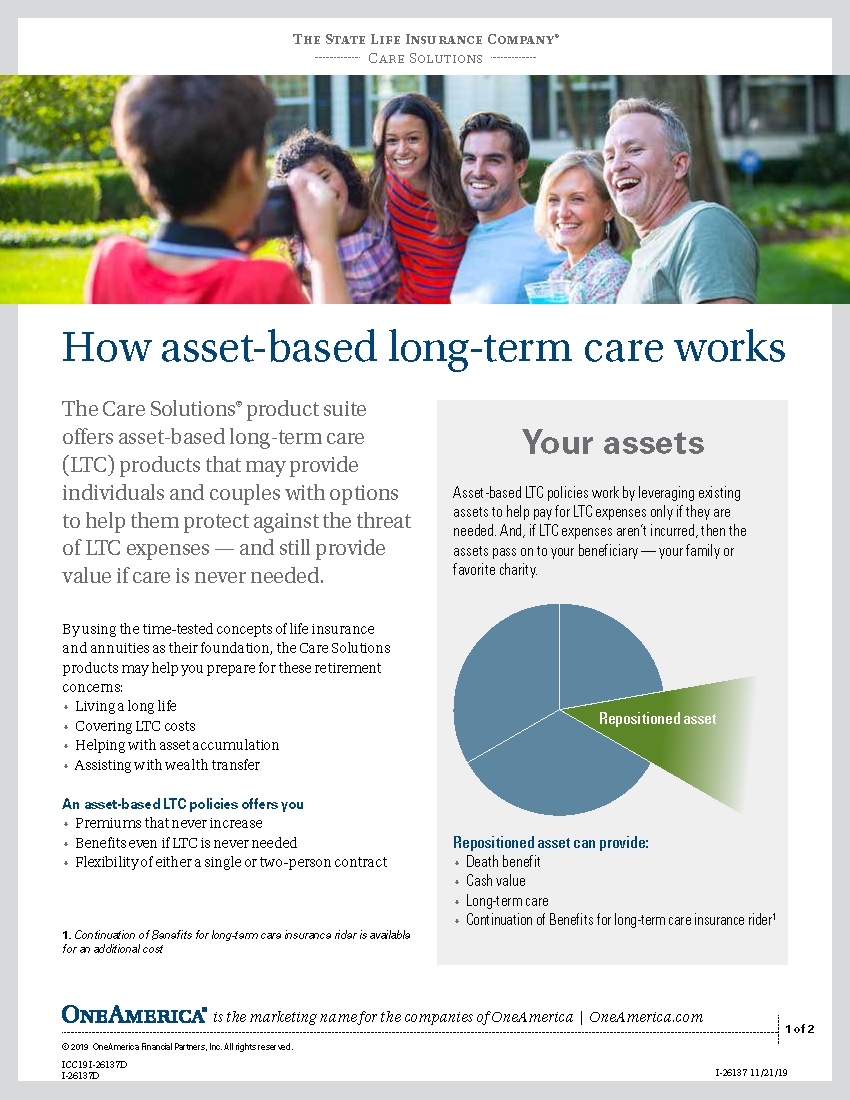

Long-Term Care Awareness Month allows us to spread the word about the importance of planning for Long-Term Care. The pandemic has certainly reinforced the need for Long-Term Care coverage, especially as it relates to at-home services. Offer clients the benefit of life insurance with the added bonus of LTC. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

- Go Through Your Existing Book of Business.

Most consumers don’t think about purchasing LTC until later in life as they near retirement. This puts the ideal client in their early 50s to mid-60s. Go through your current book of business and identify gaps in coverage — no record of life insurance and/or no record of long-term care, for instance.

- Review Standalone LTC Policies to Find Life Insurance Opportunities.

Agree to policy reviews on standalone LTC contracts. This can help you develop conversations with your clients and evaluate the performance of their existing coverage to see if it still meets their needs. If not, you may find a life insurance with a Long-Term Care rider opportunity!

- Market Risk Provides the Right Time to Ask Clients About Their Long-Term Care Plans.

Highlight the importance of having insurance to protect against a long-term care event. Clients may now understand the value of protecting their portfolio that’s already impacted by market volatility. Paying out of pocket can further devastate a financial plan.

- Talk to Female Clients.

Women have a longer life expectancy than men, outliving men by about five years on average. Many of us will face a long-term care event at some point in our lives. This is especially true for women as they make up the majority of caregivers and recipients of long-term care.

Marketing Materials

Long-Term Care Awareness Month 2022

What is Long-Term Care Awareness Month?

November is Long-Term Care Awareness Month (LTCIAM), dedicated to making sure your clients and prospective customers are informed about the need for LTC. We’re giving you the tools you need to talk to your clients about long-term care insurance.

Most people think they won’t need long-term care, but the fact is that 70% of Americans over age 65 will need it at some point in their lives. That’s why it’s important to plan ahead and have a policy in place.

We know it can be difficult to think about, but planning for long-term care is one of the most important things you can do for your clients. Our tools make it easy – so there’s no excuse not to get started today. Use our free long-term care planning tools today and work with us this month to help your clients get the coverage they need.

Grab & Go Resources

Carrier Specific Resources

Mutual of Omaha

Ready for Easier Access to Online Guides and Marketing Materials?

- NOW DIGITAL! Product Guide & Underwriting Guide – Find product specific details and all the underwriting parameters you need to know.

- The Need for LTCi Video Flyer – Share with any clients considering LTCi.

- Cost-of-Care Calculator, Sales Tools & Ideas – Brochures, calculators, collateral and more are linked in this piece.

- Social Media Posts – Join our Brokerage Facebook & LinkedIn pages to access our social media posts – content for you to share to producers and consumers!

- Webinar – Register to attend our Claims Webinar, where we will share detailed claims statistics and how to use them in sales ideas during Long-Term Care Awareness Month and beyond.

Nationwide

Start talking about LTC during Long-Term Care Awareness Month.

- Understand and plan for long-term care

- Speak to their loved one about their potential LTC needs

- Identify resources that can help those who provide care look after their loved ones

OneAmerica

Sales Ideas to End the Year

As the year nears its close, it’s not too late for your clients to take advantage of many planning opportunities before year-end. Make sure the wealth they have accumulated is protected and more efficient. There’s no better time for a comprehensive plan review.

Campaign Ideas:

- Go Through an Estate Planning Checklist.

Remind clients that even if they think they have a modest estate, it’s still important to plan. Plus, the estate tax exemption may be reduced, which could lead to an increase in estate tax. Having a plan in place also allows clients’ wishes to be honored and lessens legal difficulties. If they haven’t done so, they should engage with an estate-planning attorney as soon as possible to draft trusts and other necessary documents.

- Talk to High-Income Earners.

Given the administration’s tax proposals, high-income earners (especially those earning more than $400K a year) may find the income tax benefits of life insurance more appealing than ever. Show them how life insurance can offer cash accumulation potential to generate income-tax-free supplemental income in the future.

- Conduct Policy Reviews.

Changes in tax law occur. New and innovative products become available in the life insurance marketplace. Policy performance shifts due to market volatility or interest rates. These are all important reasons to conduct policy reviews.

- Generate New Leads.

Host a client appreciation event that appeals to a wide range of interests, such as a charity tournament or family outing.

Marketing Materials

CIAM Toolkit from Assurity

Here are some marketing pieces from Assurity that can be helpful during Critical Illness Awareness Month!

LIAM Carrier Resources & Marketing Tools

“Life Insurance – An Easy Decision.”

Each September, our industry comes together to promote Life Insurance Awareness Month (LIAM) as a reminder to all Americans of the important role life insurance plays in their financial security. Life insurance ensures families and businesses can have a bright future.

Making the Most of Life Insurance Awareness Month

Every year, we’ll gather marketing resources and materials from industry leaders to help you make the most of Life Insurance Awareness Month. Use the tools and resources on this page to access hundreds of email templates, social media posts, videos, websites, and more!

Marketing Tools and Carrier Resources

Last updated: 8/26/2022 at 9:40 am

-

Copy and paste these client approved emails that promote the quiz as a first step to a more productive conversation about life insurance.

Life Insurance Awareness Month 2022: Why Participate in LIAM?

As an insurance agent, we know how important it is to stay informed about the latest trends in the insurance industry. And since we’re committed to providing you with all the information you need to be an informed and savvy agent, we wanted to share some of the facts and figures from Life Insurance Awareness Month.

What is Life Insurance Awareness Month?

Life Insurance Awareness Month (LIAM) is a campaign that occurs every year during the month of September. The nonprofit organization, Life Happens, sponsors LIAM—a month-long campaign dedicated to helping consumers take personal financial responsibility through the ownership of life insurance and related products. As a life insurance agent, this is the perfect time to take full advantage of LIAM resources to spread the important message about life insurance to your existing clients and launch marketing campaigns aimed at new prospects.

As a life insurance agent, you’re a key player in spreading the word about the importance of life insurance to your clients and prospects.

What are the LIMRA Insurance Barometer Study results?

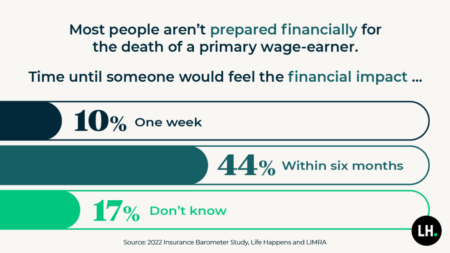

The study found that half of Americans don’t have life insurance and that COVID has made it more likely that they will purchase life insurance within the next year.1 When looking at key groups, interest is highest among Millennials (44%), Black Americans (38%) and Hispanics (37%). The purchase intent for life insurance also reached a record high this year, signaling more people are aware of the product and need.

The purpose of LIMRA’s Insurance Barometer Study is to provide a snapshot of how Americans think about life insurance and how they feel about their own coverage. For each survey, LIMRA interviews roughly 1,200 consumers who have either purchased life insurance or are considering purchasing it. They ask questions about what kinds of coverage people currently have (or don’t have), why they bought it (or didn’t buy it), and where they learned about the product.

KEY MARKET: MILLENNIALS

Millennials, ages 24 to 40, are at a time in their life when they need to be thinking about life insurance. They are typically married, have children and enjoy a sufficient salary with majority having more than $100,000 in household income.2 Yet more than half of millennials have no life insurance coverage at all, putting their loved ones at risk of financial hardship should they die unexpectedly. Misconceptions about insurance often deter them from purchasing the coverage they say they need.

The 2022 Insurance Barometer Study finds that more than one third of millennials say they don’t own life insurance because it is too expensive.3 But in general young, healthy adults are most likely to not only qualify for coverage but also be able to secure the most affordable rates.

Millennials represent the largest market opportunity for our industry with half saying they need life insurance. This is where insurance agents come in and explain how to select the right type of coverage for their circumstances and discussing options can provide additional protection for their loved ones.

Making the Most of Life Insurance Awareness Month

Every year, we’ll gather marketing resources and materials from industry leaders to help you make the most of Life Insurance Awareness Month. Use the tools and resources on this page to access hundreds of email templates, social media posts, videos, websites, and more!

Marketing Tools and Carrier Resources

Last updated: 9/19/2022 at 1:40 pm

-

Copy and paste these client approved emails that promote the quiz as a first step to a more productive conversation about life insurance.

Hybrid LTC Landscape

See how the hybrid LTC market has changed as carriers continually update their products to be competitive for your clients. Join our LTC specialist as Michael Sato, CLTC®, LUTCF®, FSS shares his knowledge of the LTC landscape and what these changes mean for you.

Protect and Grow Your Money with Insurance

Presented on July 7, 2022 at 9:30 AM HST

Presented by Brant Yamamoto, ACS, FSS & Michael Sato, CLTC®, LUTCF®, FSS

In today’s turbulent times with rampant inflation, and the market seeing a correction from historic highs, come and join us as we look at some quick sales tips on using the safety of life insurance to not only protect your money but also grow it.

Underwriting Highlights 2022

Interested in learning the latest underwriting information and how to get your cases through smoothly? Join us as Kevin Okumura, CFP® shares the latest underwriting information and how to find opportunities for complicated cases!