long-term care

Long-Term Care Awareness Month

Long-Term Care Awareness Month allows us to spread the word about the importance of planning for Long-Term Care. The pandemic has certainly reinforced the need for Long-Term Care coverage, especially as it relates to at-home services. Offer clients the benefit of life insurance with the added bonus of LTC. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

- Go Through Your Existing Book of Business.

Most consumers don’t think about purchasing LTC until later in life as they near retirement. This puts the ideal client in their early 50s to mid-60s. Go through your current book of business and identify gaps in coverage — no record of life insurance and/or no record of long-term care, for instance.

- Review Standalone LTC Policies to Find Life Insurance Opportunities.

Agree to policy reviews on standalone LTC contracts. This can help you develop conversations with your clients and evaluate the performance of their existing coverage to see if it still meets their needs. If not, you may find a life insurance with a Long-Term Care rider opportunity!

- Market Risk Provides the Right Time to Ask Clients About Their Long-Term Care Plans.

Highlight the importance of having insurance to protect against a long-term care event. Clients may now understand the value of protecting their portfolio that’s already impacted by market volatility. Paying out of pocket can further devastate a financial plan.

- Talk to Female Clients.

Women have a longer life expectancy than men, outliving men by about five years on average. Many of us will face a long-term care event at some point in our lives. This is especially true for women as they make up the majority of caregivers and recipients of long-term care.

Marketing Materials

Long-Term Care Awareness Month 2022

What is Long-Term Care Awareness Month?

November is Long-Term Care Awareness Month (LTCIAM), dedicated to making sure your clients and prospective customers are informed about the need for LTC. We’re giving you the tools you need to talk to your clients about long-term care insurance.

Most people think they won’t need long-term care, but the fact is that 70% of Americans over age 65 will need it at some point in their lives. That’s why it’s important to plan ahead and have a policy in place.

We know it can be difficult to think about, but planning for long-term care is one of the most important things you can do for your clients. Our tools make it easy – so there’s no excuse not to get started today. Use our free long-term care planning tools today and work with us this month to help your clients get the coverage they need.

Grab & Go Resources

Carrier Specific Resources

Mutual of Omaha

Ready for Easier Access to Online Guides and Marketing Materials?

- NOW DIGITAL! Product Guide & Underwriting Guide – Find product specific details and all the underwriting parameters you need to know.

- The Need for LTCi Video Flyer – Share with any clients considering LTCi.

- Cost-of-Care Calculator, Sales Tools & Ideas – Brochures, calculators, collateral and more are linked in this piece.

- Social Media Posts – Join our Brokerage Facebook & LinkedIn pages to access our social media posts – content for you to share to producers and consumers!

- Webinar – Register to attend our Claims Webinar, where we will share detailed claims statistics and how to use them in sales ideas during Long-Term Care Awareness Month and beyond.

Nationwide

Start talking about LTC during Long-Term Care Awareness Month.

- Understand and plan for long-term care

- Speak to their loved one about their potential LTC needs

- Identify resources that can help those who provide care look after their loved ones

OneAmerica

Insurance Brokerage: What It Is and Why You May Need One

Insurance brokerages are often thought of as the middlemen between insurance companies and their clients. But in reality, they perform a much broader range of services for their customers and can help you with everything from finding the right coverage for your needs, to helping you find a company willing to work with your unique situation.

What is an Insurance Brokerage?

Insurance brokerages help you navigate the confusing world of insurance. You might have questions about what kinds of insurance you need, or how much coverage you should get. An insurance broker will take the time to sit down with you and discuss your needs and goals in order to figure out what type of policy would be best for you. They’ll help you understand the basics of insurance so that you can make smart choices when it’s time to buy.

If you’ve ever felt confused about how insurance works or why it’s important to have coverage at all, an insurance broker can help clear up those questions. They can advise you on how much coverage is enough and how much should be avoided altogether. They can also help you navigate tricky situations like filing a claim, switching carriers, or buying life insurance on someone else’s behalf.

Overall, Occidental Underwriters of Hawaii can help clients find the insurance solutions they need to protect their assets, mitigate risk, and ensure peace of mind. Our experienced team can guide clients through the insurance process, from initial assessment to ongoing support and policy management.

Why do I need an Insurance Brokerage?

Insurance brokers are experts in their field—they know how to find the right policy at the right price. They can help make sure that what’s being offered is actually useful to you and meets your needs. They also have access to a wide variety of options so they can find something that works well even if it’s not available directly from an insurer. Finally, they’ll be able to answer any questions that come up during the buying process because they’ve done this many times before!

An insurance brokerage is a company that helps people find and purchase insurance.

Insurance companies are huge, and they don’t always have the time to listen to your needs or answer all of your questions. That’s where an insurance brokerage comes in. An insurance brokerage’s agent can sit down with you, take the time to understand what you want out of your insurance plan, and recommend some options that best suit your needs. They’ll also help you navigate through the process of buying a policy so that it’s as easy as possible for you.

Insurance brokerages and agents are there to help you find exactly what you’re looking for—whether it’s a simple term policy or a multi-year whole life plan—and they’ll make sure that everything goes smoothly once that policy is in place.

Occidental Underwriters of Hawaii’s Brokerage Offerings

Our company offers a variety of insurance products to protect your family and loved ones. Choose from life, long term care and critical illness insurance, disability insurance, annuities, and retirement planning solutions to help your future be secure.

Occidental Underwriters of Hawaii’s Partnered Insurance Carriers

At Occidental Underwriters of Hawaii, Ltd., we understand that the best way to provide peace of mind for our clients is to offer them a diverse selection of insurance products. That’s why we work with several different insurance carriers, each of which offers a diverse selection of insurance products.

We know how important it is to have the right coverage, and we want you to rest easy knowing that your insurance needs will be met. View our list of insurance products, carriers we work with, and services we provide!

Products and Services We Offer

Our Carrier Partners

We’re partnered with 20+ A rated carriers to provide the best options.

-

- AIG

- Allianz

- Athene

- American National

- Assurity

- The Cincinnati Life Insurance Company

- Equitable

- Great American Insurance Group

- Jackson

- John Hancock

- Legal & General

- Lincoln Financial Group

- MassMutual

- Mutual of Omaha

- Nationwide

- OneAmerica

- Pacific Guardian Life

- Pacific Life

- Principal

- Protective Life Insurance Company

- Prudential

- SBLI

- Securian Financial

- Security Mutual Life

- Symetra

- Transmerica

We Are Your Back Office Support

We can help you get your insurance coverage faster, with less hassle.

If you’re in a hurry, we can help you find quicker options should you qualify!

We are real people who care about your situation and will walk you through every step of the process.

Get Started

Our team is always here to help you get your insurance started. We believe that the best way to protect you is to know you. That’s why we take the time to get to know you, your family, and your life—all while making sure that our underwriting process is as quick and easy as possible.

Our agents are trained to understand how your insurance needs are unique, and can help you with any questions or concerns you have about your coverage options. We also have accelerated underwriting options for those who need them, and case management services for those who want them.

And because we believe in real people helping real people, our team members are all licensed agents who will take the time to explain all of our coverage options in detail, so there’s never any guesswork on your part.

Hybrid LTC Landscape

See how the hybrid LTC market has changed as carriers continually update their products to be competitive for your clients. Join our LTC specialist as Michael Sato, CLTC®, LUTCF®, FSS shares his knowledge of the LTC landscape and what these changes mean for you.

Why Care about Long-Term Care Costs – and Why a Traditional LTC Policy May Not Be Best

Originally published by: AIG Consumer Life Insurance

No wonder so many people are worried about paying for long-term care! Just look at the facts:

-

- 70 percent of people turning age 65 will likely need some type of long-term care during their lives, according to the Administration on Aging.

- Unfortunately, an American reaching age 65 today can expect to incur nearly $140,000 in future long-term care expenses, according to the Centers for Disease Control (CDC).

- Yet, Medicare doesn’t pay for services extending beyond 100 days in skilled nursing facilities.

- In fact, most people who need long-term care reside in private homes and receive their informal care from loved ones, according to the Congressional Budget Office.

- And by the time the youngest baby boomers turn 86, in 2050, the number of available family caregivers is expected to be nearly 60 percent lower than in 2013, according to the AARP Public Policy Institute.

In light of these types of concerns, some people consider purchasing a traditional, stand-alone long-term care (LTC) insurance policy, designed to pay benefits when qualified expenses occur. Examples of situations in which benefit payment can be triggered include medical certification of a severe cognitive impairment or an inability to perform two of the six activities of daily living (eating, toileting, transferring, bathing, dressing, continence).

However, the condition must be expected to impact the insured for a minimum of 90 days. Furthermore, far fewer LTC policies are available now than in years past, as many carriers have exited the market. Some people find the cost of the available LTC policies cost-prohibitive and seek more flexible, affordable solutions.

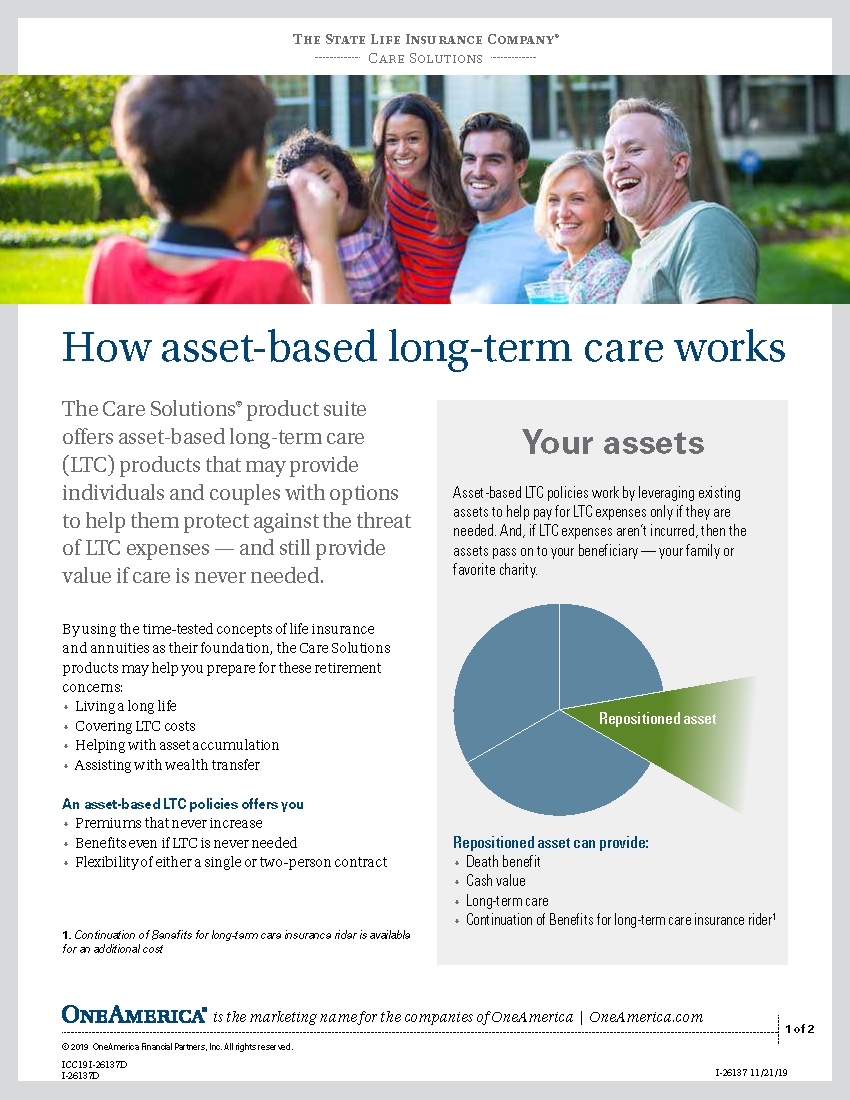

Consider Combination Products

Among the alternatives to traditional, stand-alone LTC products are combination products. These solutions include life insurance policies with built-in or available living benefit riders for long-term care specifically or for chronic illness (which often leads to the need for long-term care).

These two types of riders are designed to allow the policy holder access to an accelerated portion of the life insurance policy’s death benefit (with a corresponding decrease in the death benefit), when the terms of the rider have been met. In other words, these products are structured as multi-purpose solutions and may represent the best value for some people.

Learn about some of the differences between LTC riders and chronic illness (CI) riders on life insurance products – and why CI riders, in particular, may be the perfect choice to provide access to cash while living.

For more information, Contact Us.