Hawaii’s Exceptional Life Expectancy: Ensuring a Graceful Journey with Retirement Planning Solutions

Hawaii has the highest life expectancy in the United States, with an average of 80.7 years as of 2020. Factors contributing to this longevity include active lifestyles, dietary habits, and culture. There are challenges associated with an aging population, emphasizing the need for life insurance with long-term care, long-term care insurance, and retirement planning to enable aging in place gracefully.

Hawaii’s Longevity Secrets

Hawaii’s exceptional life expectancy can be attributed to various factors:

Active Lifestyles

Asian Americans living in Hawaii tend to lead more active lifestyles. The pleasant climate and natural beauty encourage outdoor activities, including swimming, hiking, and surfing. Such activities contribute to better physical health and, consequently, longer life expectancy.

Dietary Habits

A diet rich in fruits, vegetables, fish, and low-fat meats is typical of 80 and 90 years old in Hawaii. This diet, combined with the cultural emphasis on a balanced and nourishing way of life, and physical activity are essential.

Brain Activity

Keeping a brain active with crosswords, sudokus and reading keeps it growing, and slows dementia. Hawaiian and Asian culture emphasizes community, family, and respect for elders. The strong social support systems foster emotional well-being among the elderly including social interaction, contributing to their longevity.

Aging Challenges

While Hawaii’s high life expectancy is undoubtedly something to celebrate, it also brings certain financial challenges, particularly for individuals approaching retirement age. Planning for a longer life expectancy is vital for several reasons:

1. Retirement Savings

Many people face challenges related to insufficient retirement savings. It’s essential to save adequately for retirement to maintain the same standard of living.

2. Social Security

Relying solely on Social Security may not provide enough income to cover living expenses. Social Security payments may not keep pace with inflation, leaving retirees with a reduced purchasing power.

3. Inflation

Inflation erodes the real value of money over time. Retirees on a fixed income may find it challenging to maintain their desired lifestyle when the cost of living rises.

4. Debt

Carrying debt into retirement can be burdensome. Mortgage payments, credit card debt, or student loans can deplete retirement savings.

Managing Financial Risks by Planning

To navigate the challenges of aging gracefully and enjoy the benefits of a long life, it’s essential to consider various solutions.

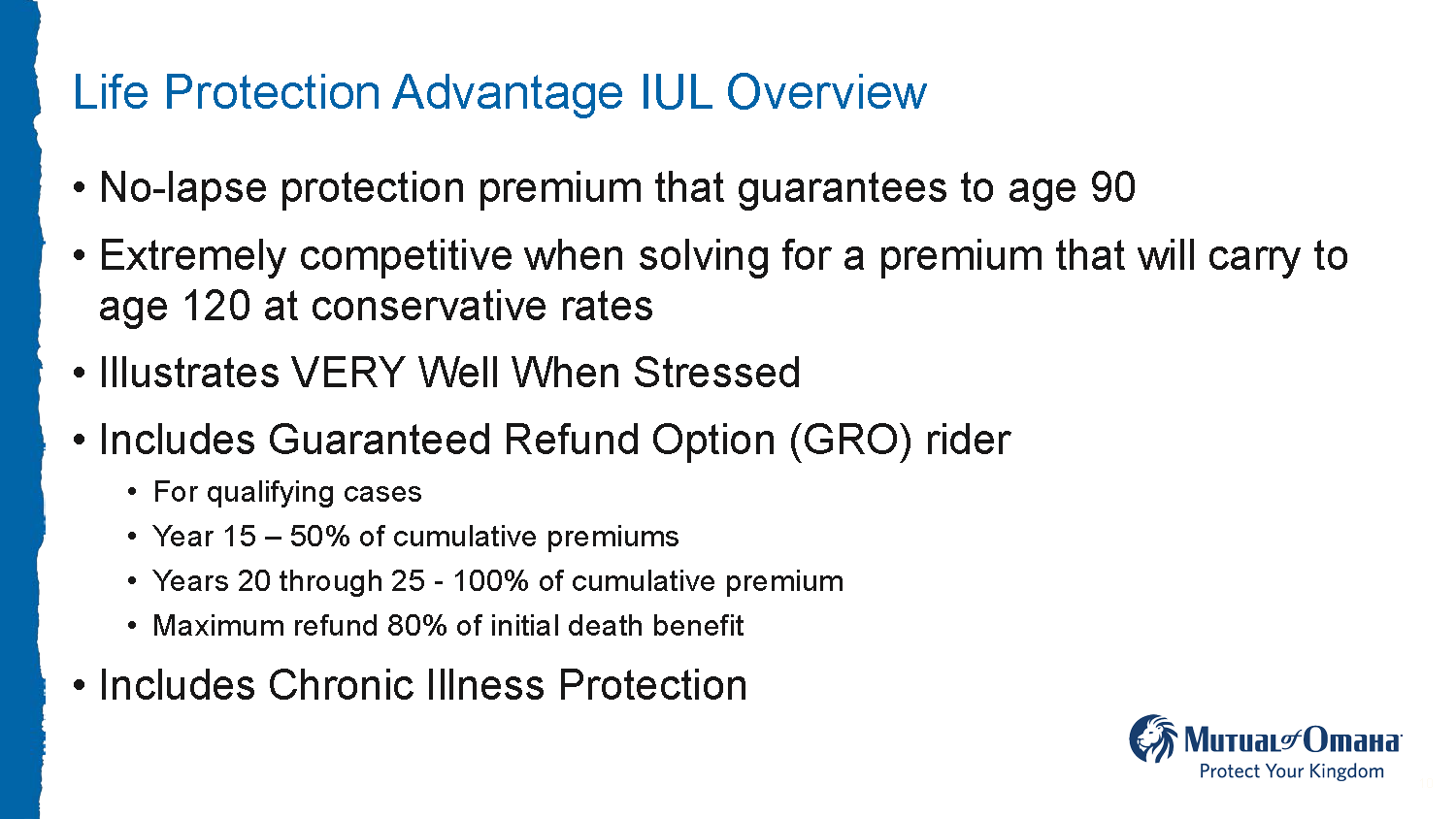

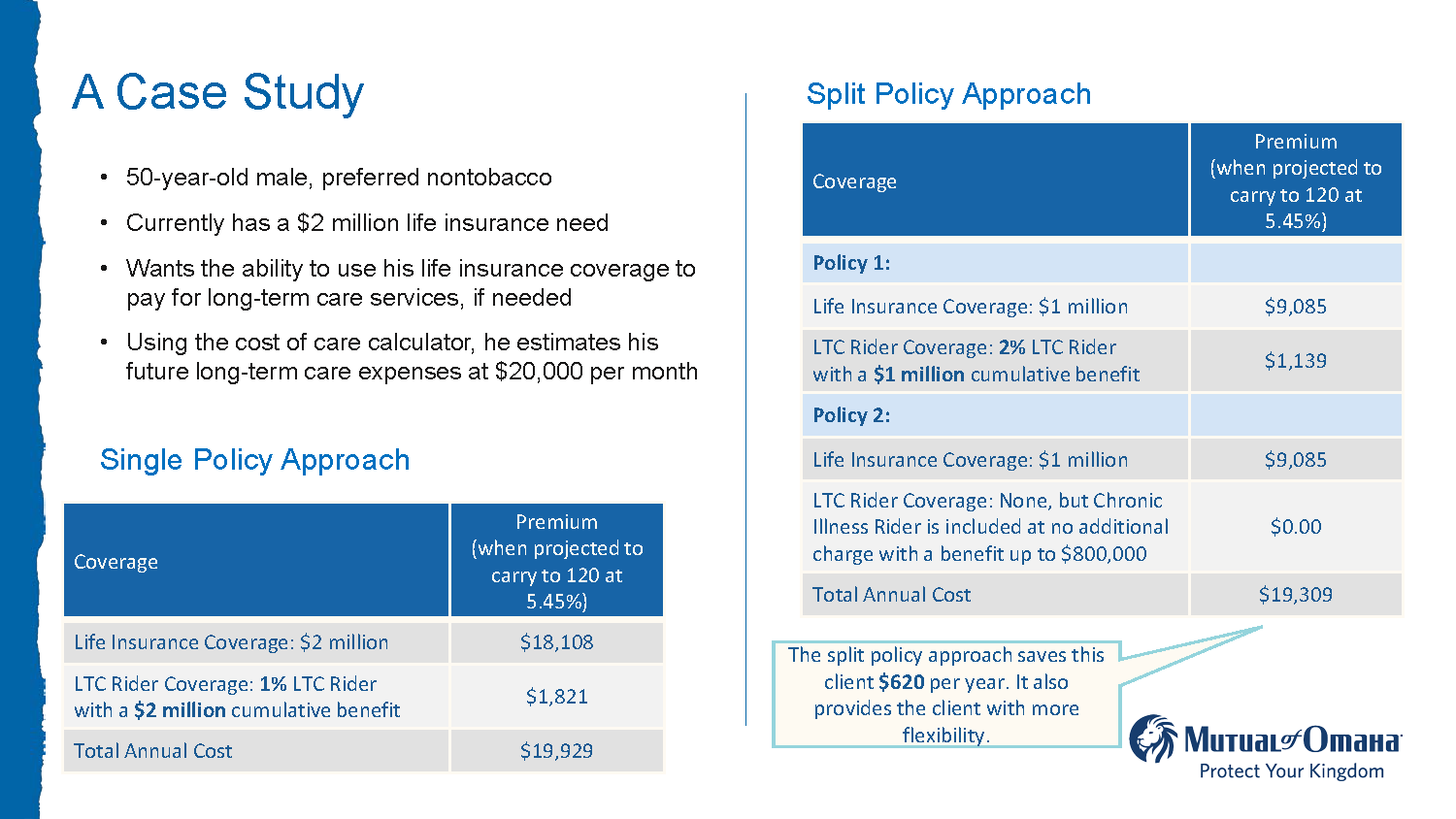

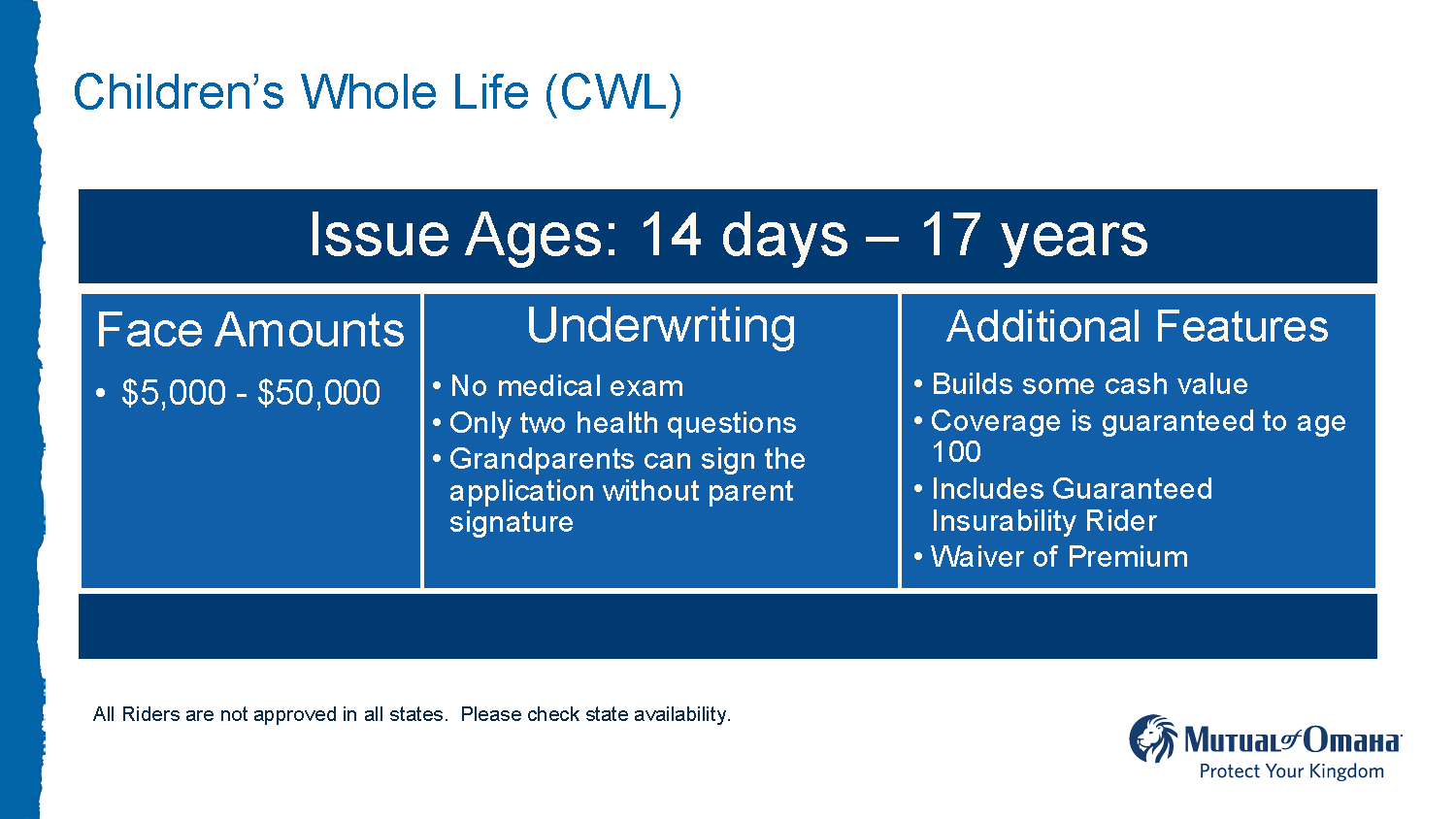

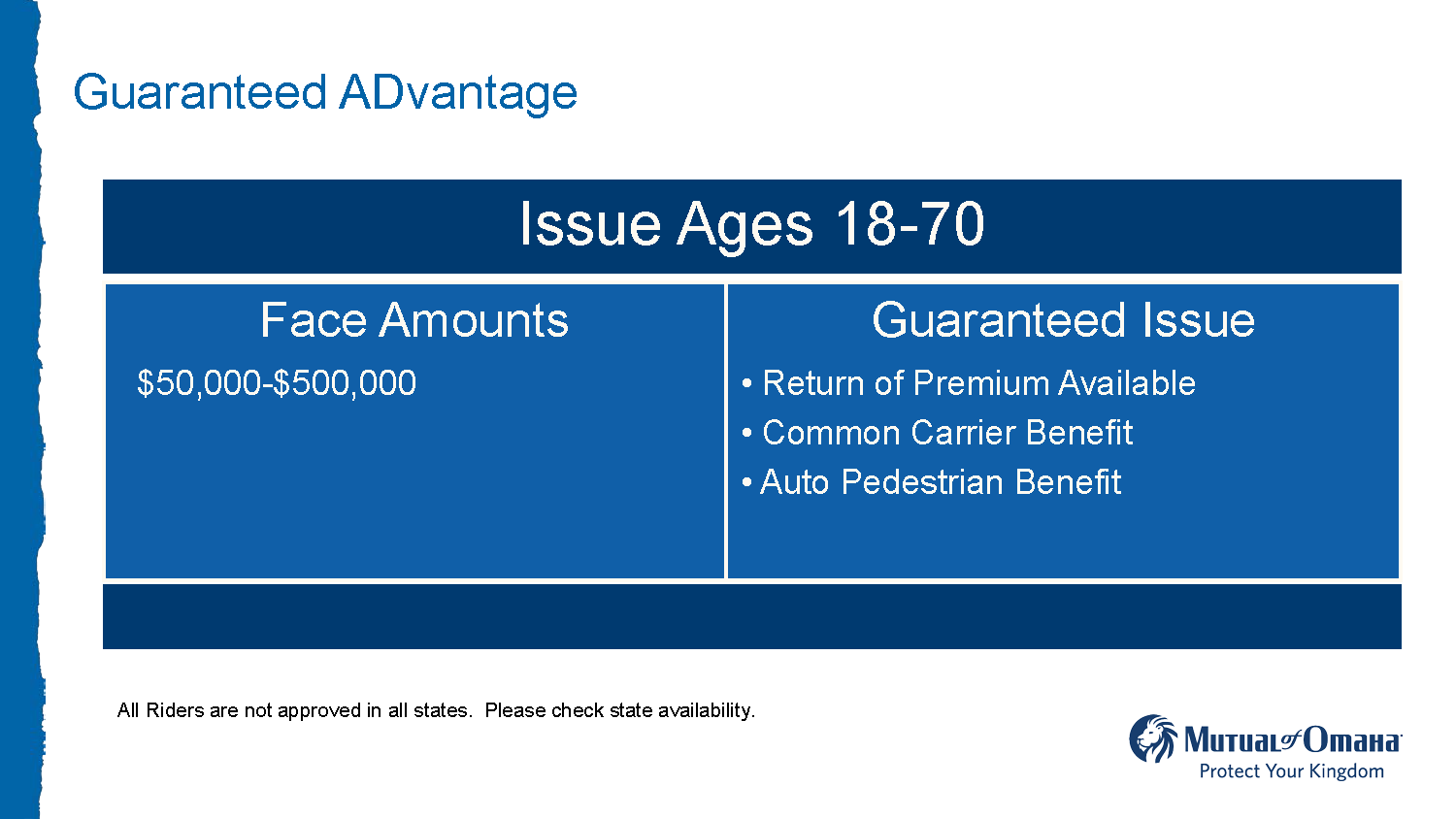

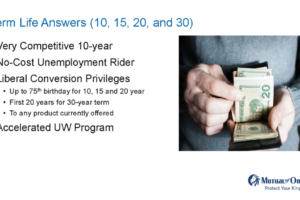

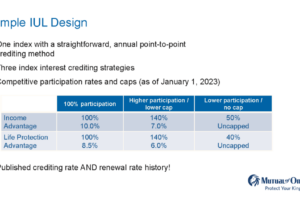

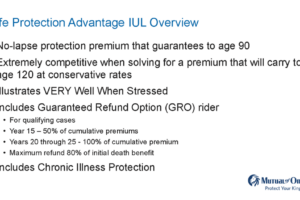

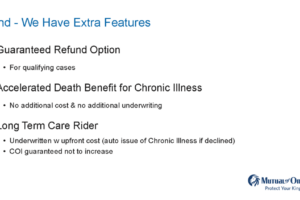

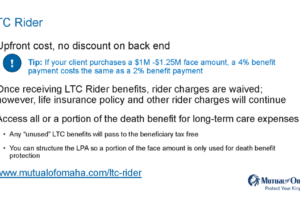

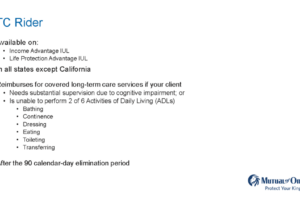

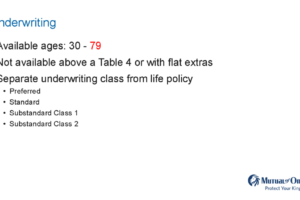

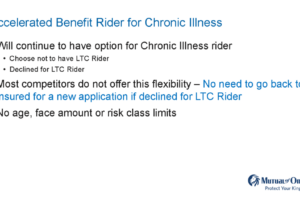

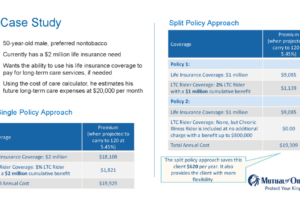

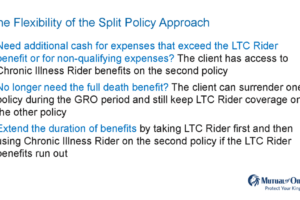

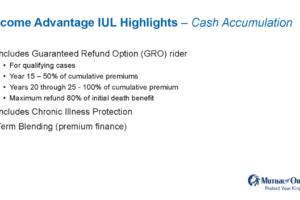

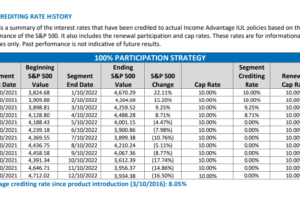

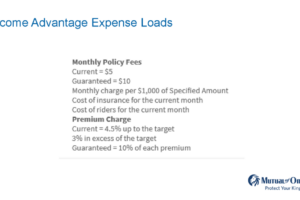

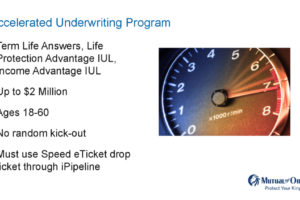

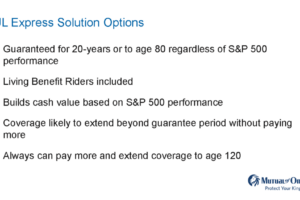

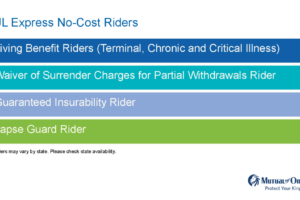

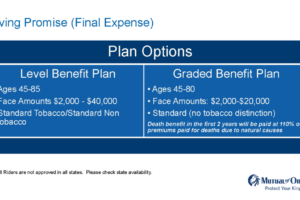

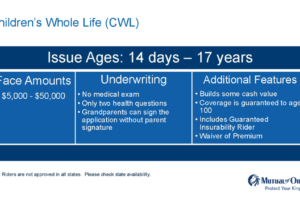

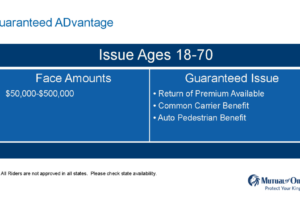

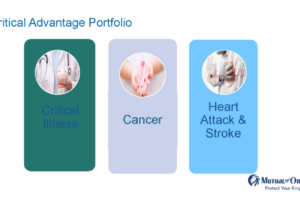

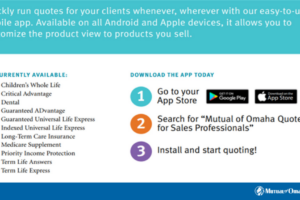

Life Insurance with Long-Term Care Riders

Life insurance policies with long-term care riders provide financial support for both the insured and their beneficiaries. These policies allow policyholders to access a portion of their death benefit to cover long-term care expenses, offering financial flexibility and security.

Long-Term Care Insurance

Long-term care insurance policies are designed specifically to cover the costs associated with long-term care services. These policies can alleviate the financial burden on individuals and their families.

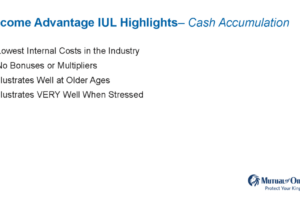

Annuities and Retirement Planning

Annuities can provide a source of income in retirement, helping seniors maintain their standard of living. Proper retirement planning, which may include annuities, is essential to ensure financial security in old age.

Income-Generating Investments

Consider investments that provide regular income, such as dividend-paying stocks, bonds, or real estate investments. These can supplement your retirement income.

Estate Planning

Create a comprehensive estate plan to minimize estate taxes and ensure your assets are distributed according to your wishes. This may involve using trusts and wills.

Social Security Optimization

Understand how to maximize your Social Security benefits by delaying your claim if possible, as this can increase your monthly benefit.

Diversify Investments

Diversification can help manage investment risk. Spread your investments across different asset classes to reduce exposure to any single risk.

Conclusion

As individuals approach retirement, it is essential to consider these challenges and plan accordingly.

Financial professionals can play a pivotal role in guiding individuals toward suitable solutions, such as life insurance with LTC riders and standalone LTCI. Contact a financial professional to review your options. Hawaii’s exceptional life expectancy serves as a model for the rest of the nation, emphasizing the importance of combining healthy living, cultural values, and the right financial strategies to ensure a longer and more comfortable life for our aging population.

TLDR; Be Proactive

Addressing these challenges requires proactive financial planning. Insurance products, such as life insurance with long-term care riders and long-term care insurance, can provide a safety net for aging individuals and their families, allowing them to age in place gracefully without the burden of exorbitant healthcare costs.