This is your guide to disability insurance also called disability income (DI) insurance and understanding how the product works. Hard work doesn’t come easy, and neither does money. That’s why there’s insurance to protect the money you make. Disability insurance is one way to make sure you stay afloat financially when an unforeseen event happens.

Why do I need disability insurance?

Most people have enough savings to cover their lost income for about three to six months. However, if you become injured or too sick to work for an extended period of time, DI could help cover a portion of your income including bonuses and commissions. It’s important to know that even if you have group long-term disability insurance through your employer, it may not be enough.

The most important asset you have is your ability to earn a living. It’s a scary thought but if you weren’t able to work, how would you live? Where would the money come from? How would you pay for your expenses? Your earning power – your ability to earn an income – is a valuable asset. Imagine that today your income is covering your expenses, but tomorrow you experience an event that leads you to become disabled. You want to get disability insurance because in the off chance that you become severely disabled, your family won’t suffer the financial consequences.

Younger people aren’t immune to a disability. In fact, one in four 20-year-olds will experience a disability for 90 days or more before they reach age 67, according to the Social Security Administration.

How disability insurance works

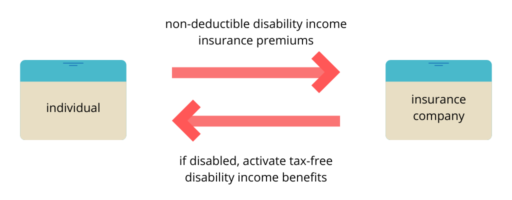

Disability insurance is an agreement made between an insurance company and the policyholder. In exchange for monthly payments you make (premiums), the insurance company agrees to pay you a monthly benefit amount if you suffer a disability that affects your ability to work. This is designed to replace around 70% of the income you would lose, but not 100% of the income.

An individual will pay non-deductible disability income insurance premiums to the insurance company, and in exchange if the individual becomes disabled, the individual will receive tax-free disability income benefits.

The disability income benefits are subject to a waiting period – the time you are considered disabled before the benefits begin – typically 60, 90, 180, 365, or 730 consecutive days of disability. Disability income benefits are often in periods of one year, two years, five years and to age 65.

An adequate amount of personally-owned DI, coordinated with other sources of income, can guarantee a source of income in the event of serious illness or injury.