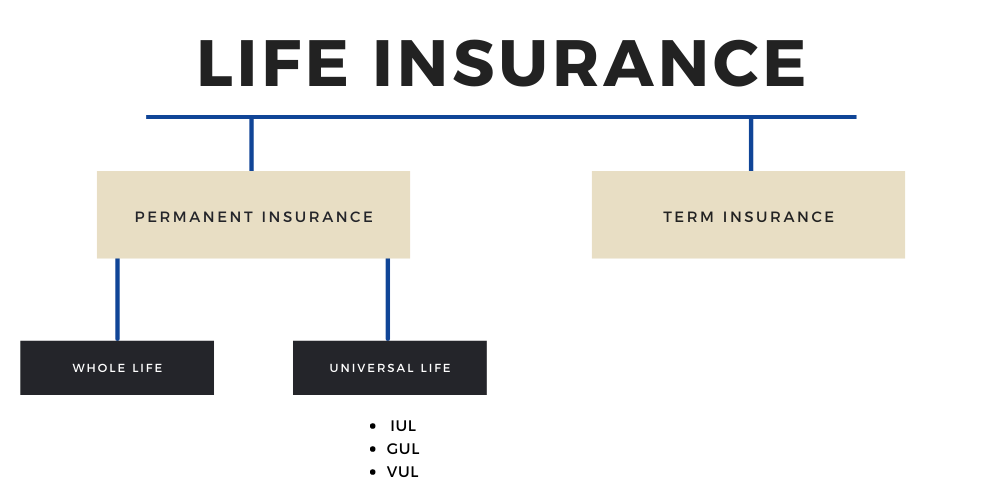

Term Insurance

Understanding the basics of Term Insurance

Term insurance is straightforward, providing coverage for a set number of years. Typically, term insurance coverage ranges from 5-30 years but can vary depending on the insurance company you purchase from. The length of a policy is determined between your insurance agent and yourself by finding the best solution for your needs.

Is term insurance the right fit for me?

Term insurance is best for those who need coverage but are tight on money and for those who only need coverage for a certain amount of years (i.e., to cover a 30-year mortgage). It provides the most coverage for the lowest premium, meaning you get more for your money. Unlike permanent insurance, there is no cash component, so you won’t have the ability to gain or borrow cash from the policy. You can convert to permanent insurance if your policy allows, so check with your agent!

Types of Term Insurance

Convertible Term: Term insurance that allows the policy owner to convert their policy to permanent insurance without undergoing underwriting, submitting medical exams, or health condition history.

Increasing Term: Term insurance that allows the policy owner to increase the death benefit with time. As the death benefit increases, so do the premium payments.

Decreasing Term/Mortgage Term: Term insurance that decreases over time. Decreasing term insurance is often called Mortgage term because it works to cover the risk of your mortgage if you pass away during that period. The downside is that although premiums are smaller than straight term, the premiums remain constant even though the death benefit declines.

Annual Renewable Term: Term insurance that increases each renewable year. The benefit of the Annual Renewable Term is that the coverage is guaranteed to be approved each year. However, the premiums will also increase too.