Long-Term Care Awareness Month

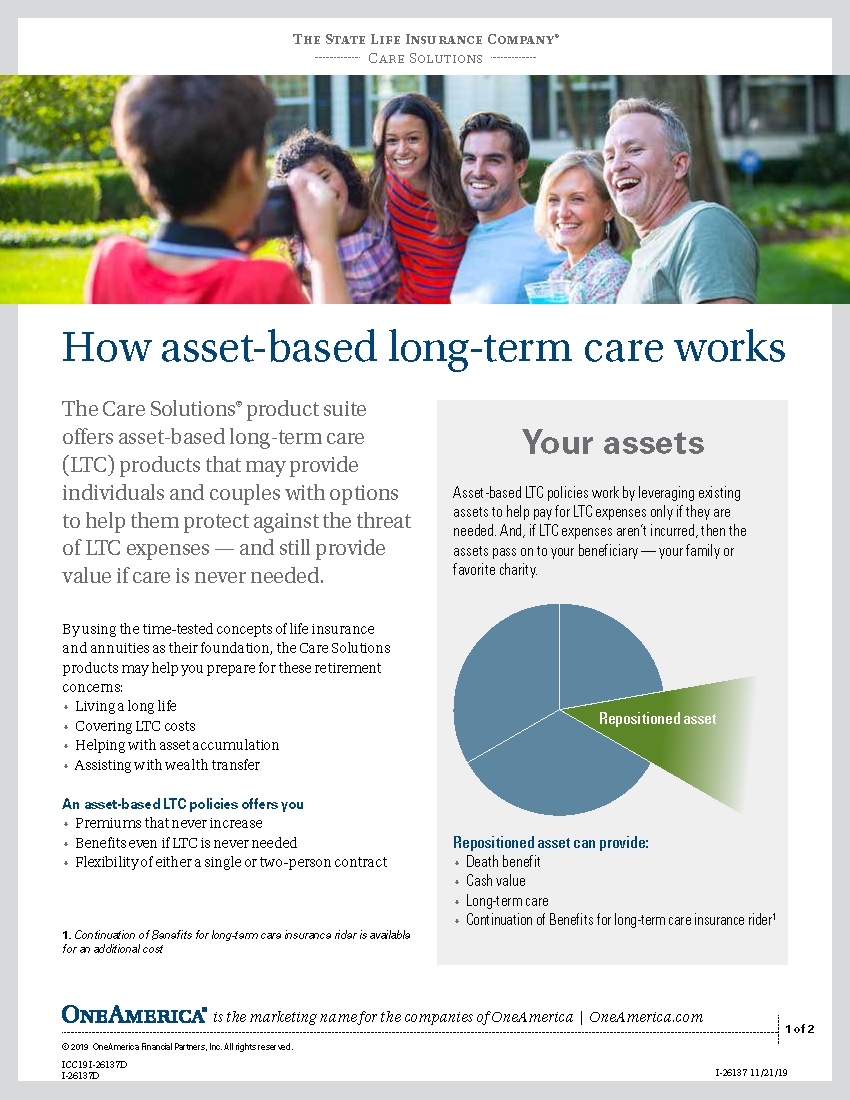

Long-Term Care Awareness Month allows us to spread the word about the importance of planning for Long-Term Care. The pandemic has certainly reinforced the need for Long-Term Care coverage, especially as it relates to at-home services. Offer clients the benefit of life insurance with the added bonus of LTC. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

- Go Through Your Existing Book of Business.

Most consumers don’t think about purchasing LTC until later in life as they near retirement. This puts the ideal client in their early 50s to mid-60s. Go through your current book of business and identify gaps in coverage — no record of life insurance and/or no record of long-term care, for instance.

- Review Standalone LTC Policies to Find Life Insurance Opportunities.

Agree to policy reviews on standalone LTC contracts. This can help you develop conversations with your clients and evaluate the performance of their existing coverage to see if it still meets their needs. If not, you may find a life insurance with a Long-Term Care rider opportunity!

- Market Risk Provides the Right Time to Ask Clients About Their Long-Term Care Plans.

Highlight the importance of having insurance to protect against a long-term care event. Clients may now understand the value of protecting their portfolio that’s already impacted by market volatility. Paying out of pocket can further devastate a financial plan.

- Talk to Female Clients.

Women have a longer life expectancy than men, outliving men by about five years on average. Many of us will face a long-term care event at some point in our lives. This is especially true for women as they make up the majority of caregivers and recipients of long-term care.