How COVID-19 has affected the Life Insurance Industry

The life insurance industry relies heavily on in-person interaction. Typically, an insurance agent will meet with you to determine if you are a good candidate for life insurance and shed light on why you would need it. For example, major life event milestones triggering the need for life insurance include buying a house and holding a mortgage, having a child, or getting married.

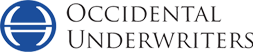

So what is Life Insurance? The primary purpose of life insurance is to provide a financial safety net to loved ones upon the premature death of the insured person(s). A life insurance policy is a contract between the insurance company and the insured. If the insured passes away within the contract period, the insurance company will pay money, death benefit, to your family. Life insurance is an integral part of sound financial planning.

What does life insurance do for you?

- Provides income replacement

- Covers debt and losses

- Can provide tax benefits

- Fund a college education

- Provides peace of mind to you and your loved ones

- Rounds out your retirement plan

COVID-19 and the Life Insurance Industry

Over the past couple of years, our industry has utilized electronic tools as a proper way to do business. With e-Application processes, expedited underwriting, and the option to get a policy without bloodwork or labs, purchasing life insurance online has never been more efficient and easy. 44% of the population would prefer to get their life insurance quotes online, and 36% prefer to purchase online. With simplified underwriting, you can skip the entire underwriting process — that means no exams, bloodwork, or medical records for qualified individuals. Use our 3 step process and get the coverage you need without the hassle of full underwriting.

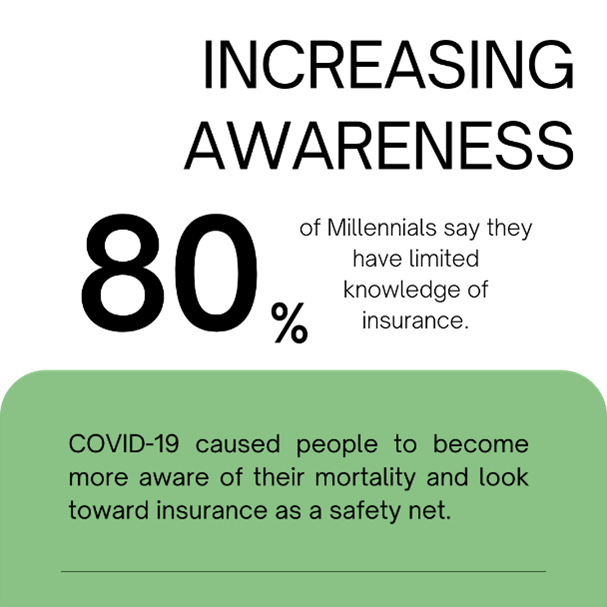

COVID-19 has caused people to become more aware of themselves and their loved ones, their mortality, and the long-term retirement risks that they carry. Specifically, life insurance purchases skyrocketed in 2020 within the younger age groups, ages 0-59. However, 80% of millennials say they have limited knowledge of insurance.

At Occidental Underwriters, we provide a wealth of knowledge in insurance services and, with nearly 90 years in the industry, we pride ourselves on providing the best options for you. Speak with an agent today.

Source: “The Future of Life Insurance: Reimagining the industry for the decade ahead” LIMRA and McKinsey & Company. https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/the%20future%20of%20life%20insurance%20reimagining%20the%20industry%20for%20the%20decade%20ahead/the-future-of-life-insurance-final.pdf