Policy Review

A Policy Review is designed to help you develop conversations with clients and evaluate the performance of their existing insurance coverage to see if it still meets their needs. Purchasing life insurance isn’t a “set it and forget it” transaction. There are many factors that may impact a client’s policy. As life changes, needs change too. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

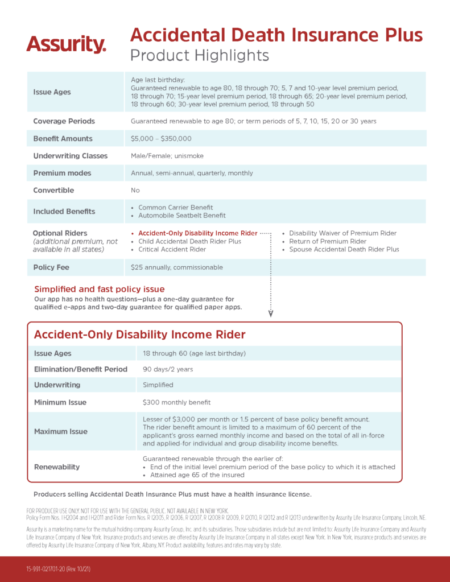

- Lifestyle Changes.

Did your client just get married? Divorced? Purchase a home? Have a child? There could be a gap in the amount of coverage your clients need.

- Business Related.

Did your client switch careers? Is there a new business venture or possibly a business ownership change? Make sure your client is protected with the right coverage.

- Changes In Health.

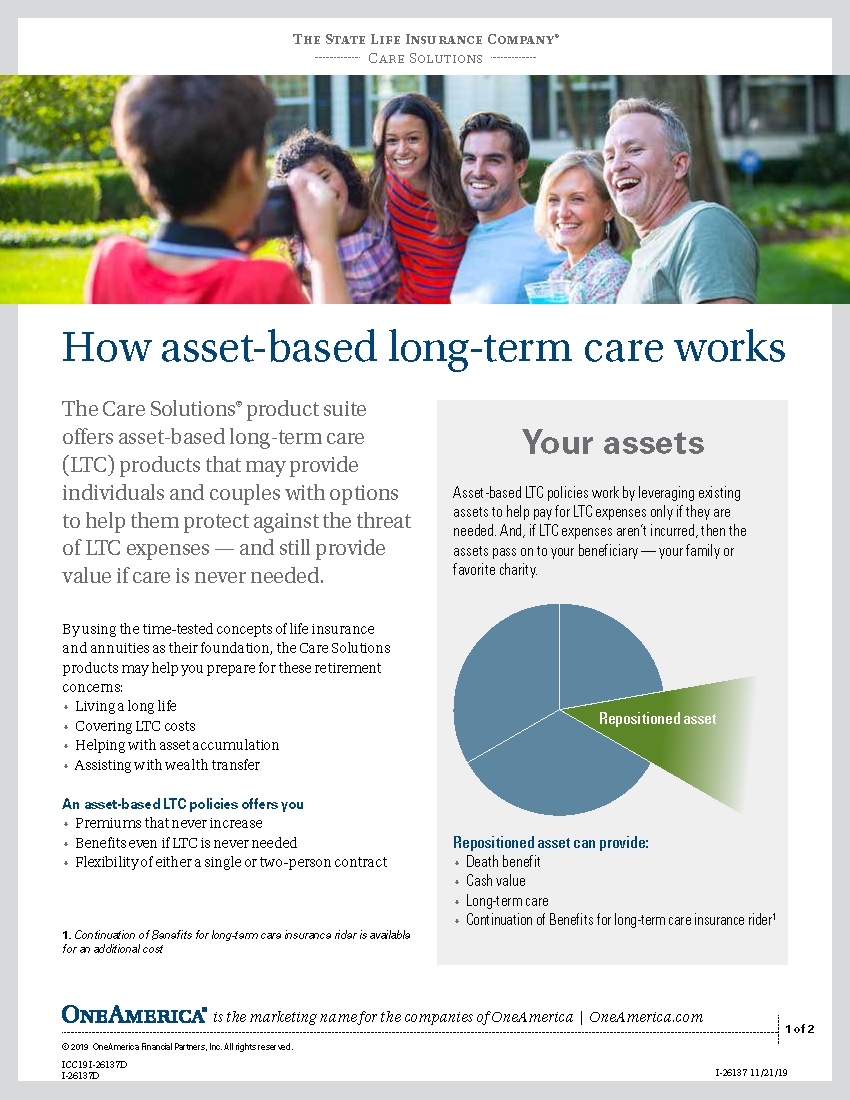

Your client (or their spouse) may now have a positive development in their health. Perhaps they’re thinking about long-term care benefits as they age. Maybe they have Term policies approaching conversion date expiration. Highlight how additional coverage and/or policy changes would adapt to current circumstances.

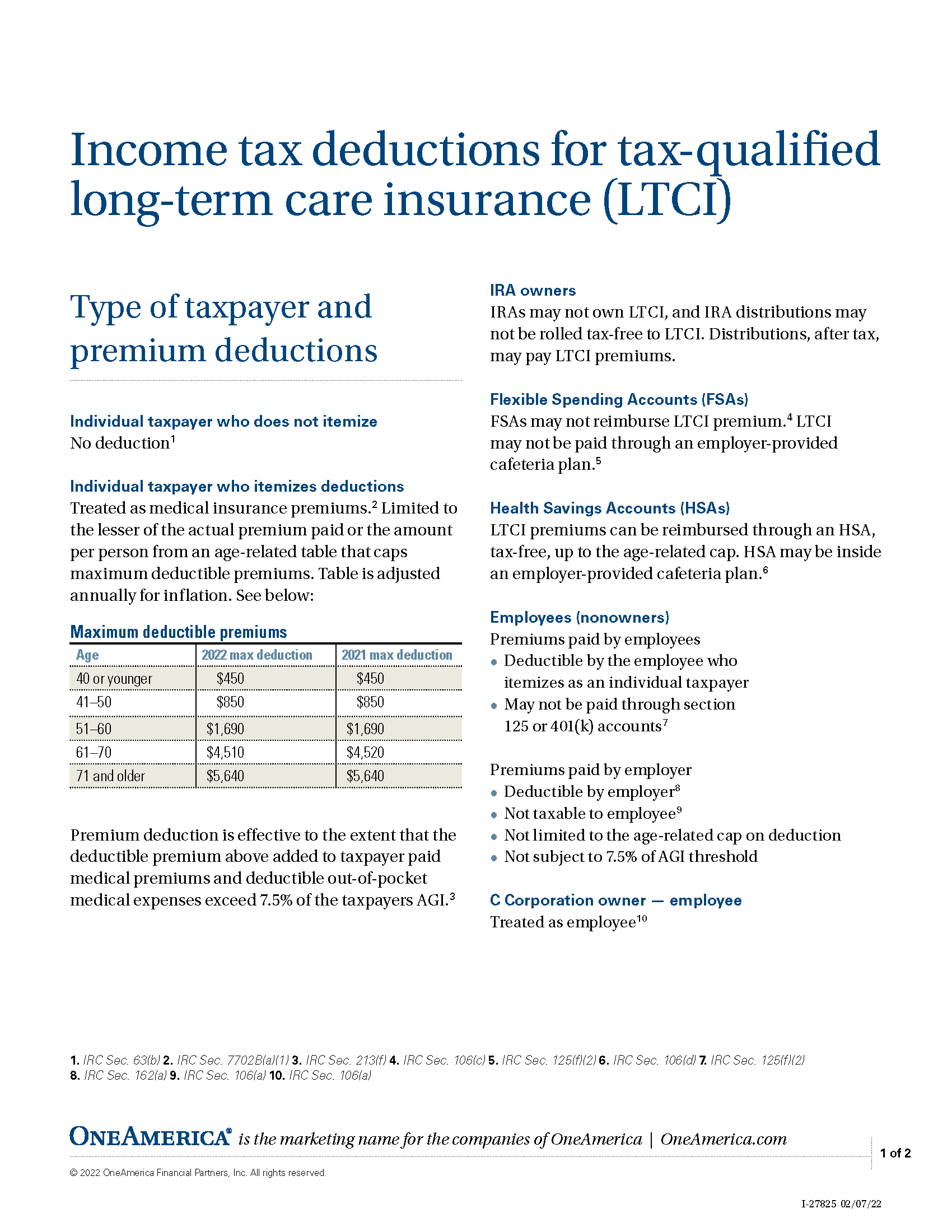

- Legislative and Industry Specific Factors.

Changes in tax law occur. New and innovative products become available in the life insurance marketplace. Policy performance shifts due to market volatility or interest rates. These are all important reasons to conduct policy reviews.