Resources

Policy Review

A Policy Review is designed to help you develop conversations with clients and evaluate the performance of their existing insurance coverage to see if it still meets their needs. Purchasing life insurance isn’t a “set it and forget it” transaction. There are many factors that may impact a client’s policy. As life changes, needs change too. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

- Lifestyle Changes.

Did your client just get married? Divorced? Purchase a home? Have a child? There could be a gap in the amount of coverage your clients need.

- Business Related.

Did your client switch careers? Is there a new business venture or possibly a business ownership change? Make sure your client is protected with the right coverage.

- Changes In Health.

Your client (or their spouse) may now have a positive development in their health. Perhaps they’re thinking about long-term care benefits as they age. Maybe they have Term policies approaching conversion date expiration. Highlight how additional coverage and/or policy changes would adapt to current circumstances.

- Legislative and Industry Specific Factors.

Changes in tax law occur. New and innovative products become available in the life insurance marketplace. Policy performance shifts due to market volatility or interest rates. These are all important reasons to conduct policy reviews.

Marketing Materials

Modern Sales Strategies for Millennials by Assurity

“Modern Sales Strategies for Millennials” by Assurity

March 2, 2023, at 9:30 am

Join us as we introduce Assurity Life’s Lorraine Jessich and David Everly. They’ll discuss StartSmart, Assurity’s 3-in-1 affordable coverage solution that protects life, health, and income. With StartSmart, there’s no medical exam, meaning a quick turnaround for your clients. Plus, gain tips on how to effectively target the largest living adult generation.

Lunch & Learn #1 “Using Qualified Money for LTC”

Our Lunch & Learn series is a great opportunity for you to learn about new topics or brush up on your knowledge. View the materials used in our Lunch & Learn session #1 (February 8, 2023), “Using Qualified Money for LTC” where you’ll learn about what qualified money is and how it can help your clients obtain long-term care.

Materials:

If you have any questions, please ask Michael Sato at [email protected] or at ext. 869.

Washington State Long-Term Care Trust Act: What You Need to Know

The passage of the Long-Term Care Trust Act (HB1087), which becomes effective on January 1, 2022, makes Washington State the first state in the nation to create a publicly funded insurance program for workers. The program will be funded by employees, who will pay taxes through payroll deductions, similar to the Family Leave and Medical Leave plans that were enacted in 2018.

Updated on 1/31/2023

Marketing Materials

-

- CareChoice One Applications from Washington State Suspended

- CareChoice Select (12 Pay) and LTCAccess Rider Sales Suspended in Washingotn State, CareChoice One (Single Pay) Minimum Premium Raised to $50k.

- MassMutual CareChoice Select Minimum Face Amount in Washington State Raised to $75k, and Only Annual Premium Mode Will Be Allowed

- MassMutual’s CareChoice Products and Whole Life with LTCAccess Rider Applications Resume in Washington State

-

- Important Update Regarding Long-Term Care Sales in Washington State

- Long-Term Care Sales Update in Washington State

- The Long-Term Care Trust Act – Washington State Enacts First Social Insurance Program for LTC

- Sales Update in Washington State

- Update On Life Insurance Processing Updates for Washington State

- CareMatters Sales Resume in Washington State Effective February 4, 2022

-

- An Overview of the Washington LTC Payroll Tax

- Suspension of Asset Care Sales in Washington State, Effective August 14

- Suspension of All Asset-Based LTC Sales in Washington State, Effective August 14

- Temporary Asset Care Product Changes for Washington State, Effective July 31

- The WA Cares Fund

- WA Long-Term Care Application Processing Update

Insure Your Love 2023

The purpose of life insurance is to provide financial security and peace of mind. It ensures that loved ones aren’t left with a financial burden after the policyholder passes away.

February is an important month to recognize those we love, and it can also serve as a helpful reminder to look into life insurance plans. Throughout the month of February, Life Happens, a nonprofit organization aimed to give unbiased information to help make smart insurance choices, hosts Insure Your Love Month.

Life insurance carriers are also emphasizing the importance of life insurance policies for anyone who loves someone else in their life. Take the time to discuss with your family or clients about life insurance – whether this be a family member, partner, friend, or customer – life insurance offers protection for loved ones if anything were to happen. Talking about life insurance with your clients is essential in order to ensure their loved one’s financial security no matter what life throws at them.

Life Insurance Resources a list by Occidental Underwriters of Hawaii

LifeHappens

- Insure Your Love Producer Homepage

- Insure Your Love Consumer Homepage

- Life Insurance Real Life Stories & Videos

- Owning Life Insurance Provides a Clear Path to Financial Security

- 2022 Insurance Barometer Study Reveals the Secret to Financial Security is Owning Life Insurance

- For Love and Money

Carrier Handouts

- Allianz – How to Help Clients Create a Tax Strategy

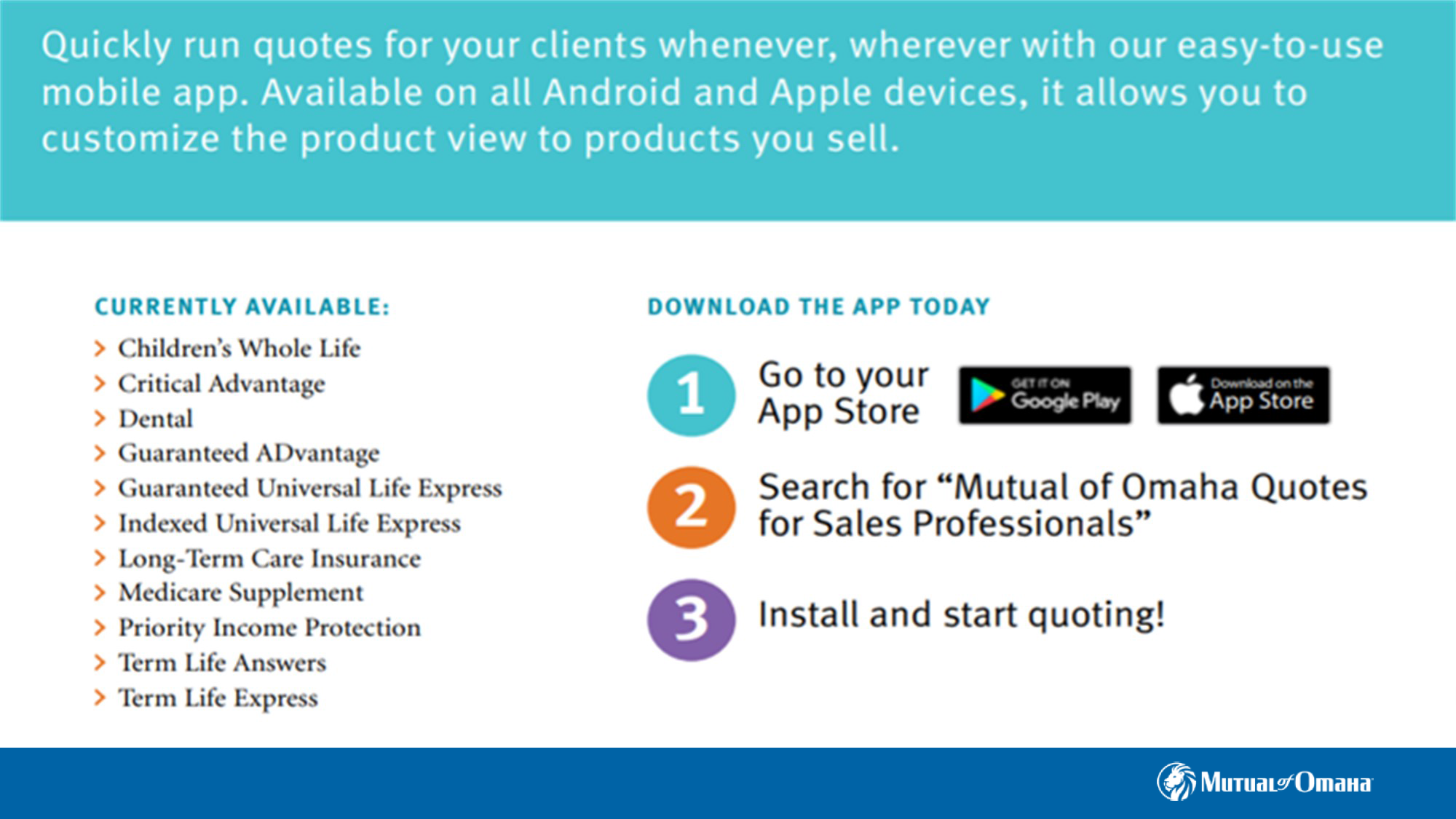

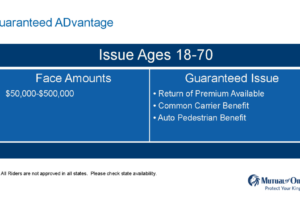

- Mutual of Omaha – Clients Like Convenience and Quick Decisions

- Pacific Life – Framing Your Legacy

- Principal – Six Steps to Create Your Post-Pandemic Business Growth Plan

- Prudential – The Secure 2.0 Act

- Prudential – The Term Essential Reprice – What It Means for You and Clients

Media Coverage

Life Insurance Stories

Annuity Suitability Best Interest Requirements

Presented on: January 17, 2023 at 9:30 am

Effective January 1, 2023, licensed insurance producers will need to comply with best interest standards and disclosure requirements when selling annuities and must do so by July 1, 2023.

In this webinar, we’ll be covering what’s required from a producer to comply with the new rule (NAIC Model #275). Join us for an informative session that will help you get up to speed on the new requirements.

Planning Opportunities in the New Year

Although it’s too early to know exactly what tax laws will look like this year, clients should still take some specific steps to prepare. It’s important to have a plan – whether it be for untimely death, disability or long-term care needs. There are a variety of planning opportunities to discuss with your clients in the new year. Explore our campaign ideas, packaged marketing resources and more!

Campaign Ideas:

- Hit the Ground Running with Policy Reviews.

Many clients make new year’s resolutions that involve their finances. Offer to conduct thorough reviews of their life insurance and long-term care policies. Changes in tax law may occur. Policy performance shifts due to market volatility or interest rates. Give clients peace of mind by making sure they have the correct protection in place.

- Go Through an Estate Planning Checklist.

Remind clients that even if they think they have a modest estate, it’s still important to plan. Plus, the estate tax exemption may be reduced, which could lead to an increase in estate tax. Having a plan in place also allows clients’ wishes to be honored and lessens legal difficulties. If they haven’t done so, they should engage with an estate-planning attorney as soon as possible to draft trusts and other necessary documents.

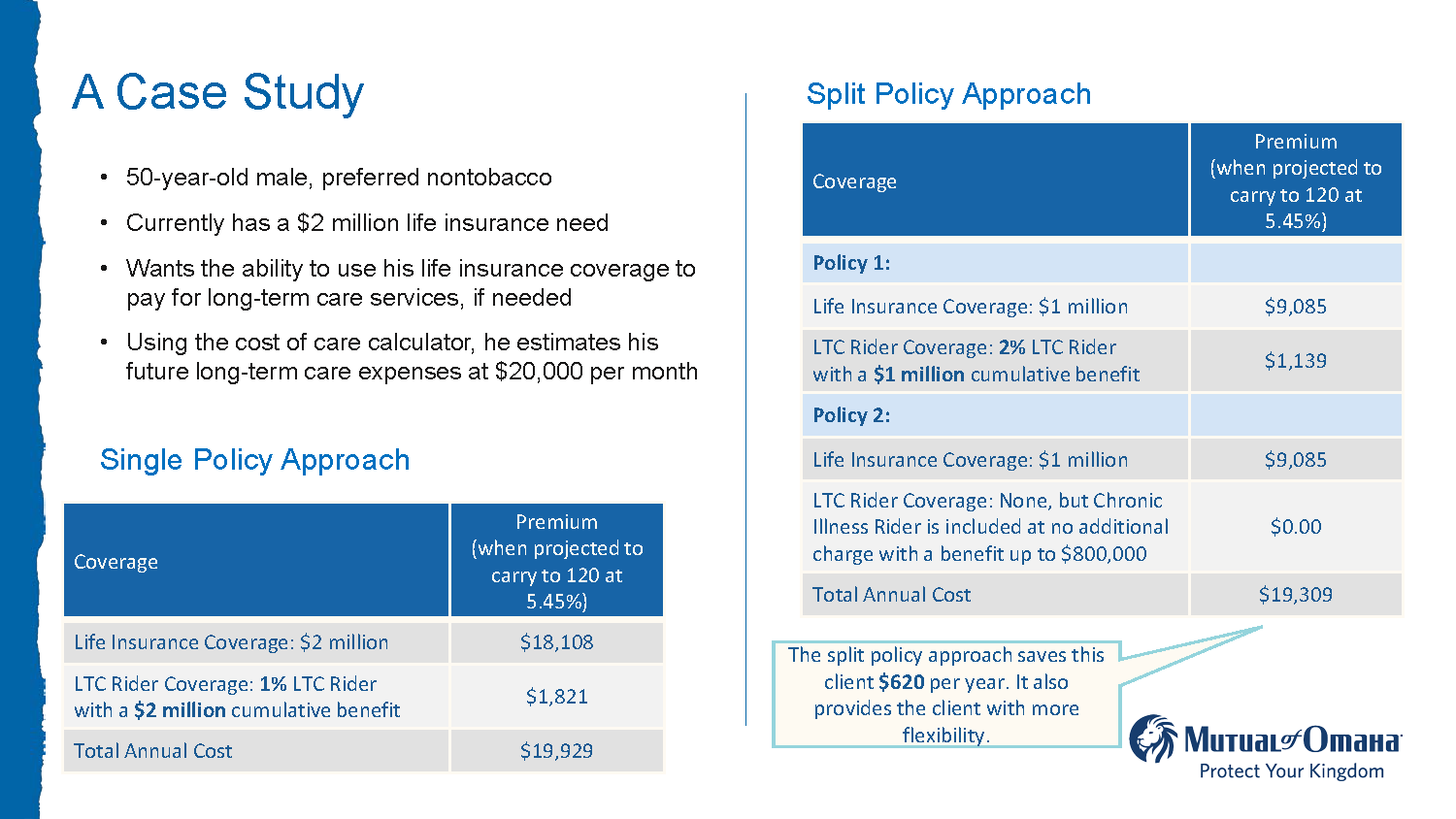

- Asset Maximization.

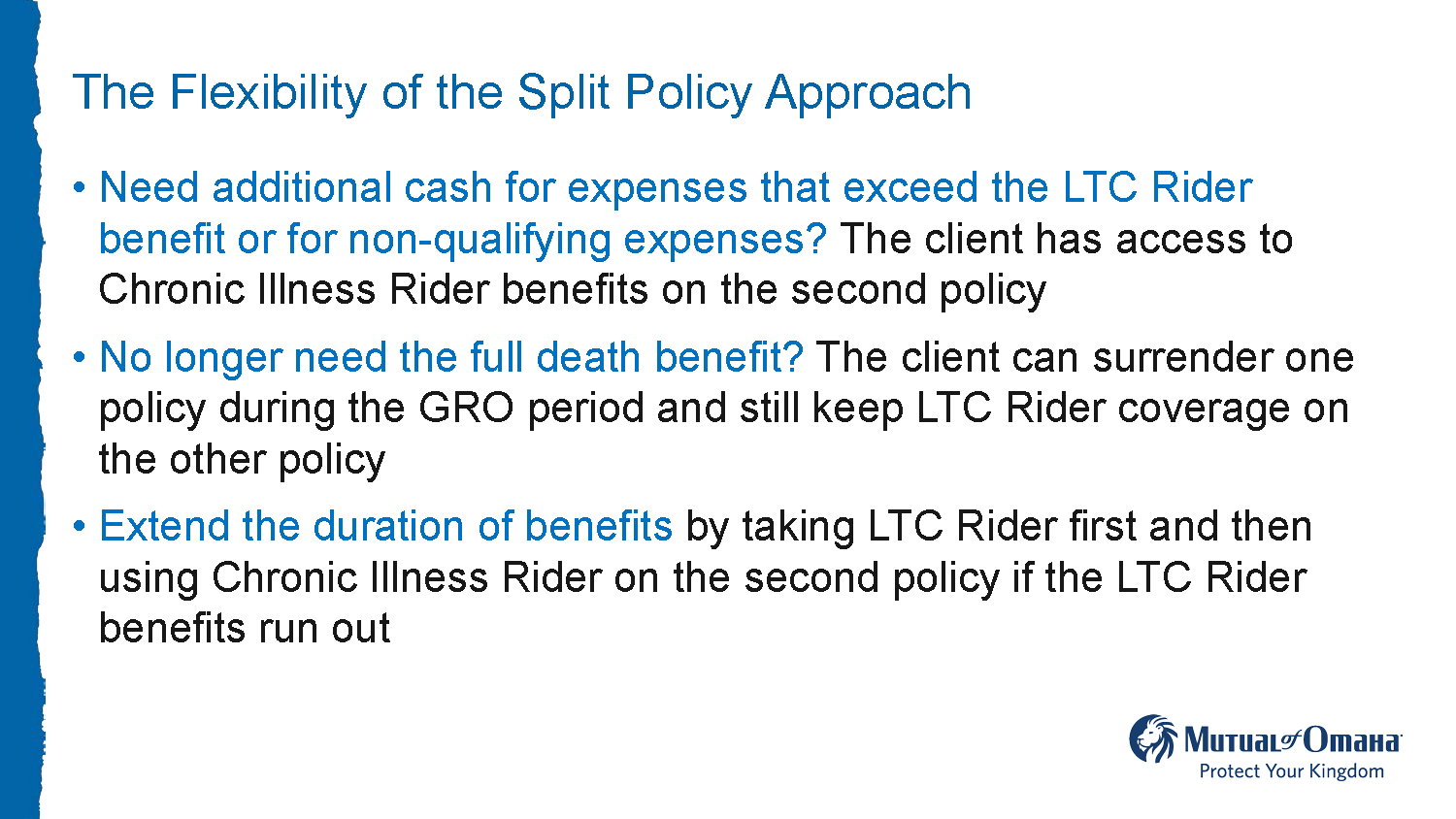

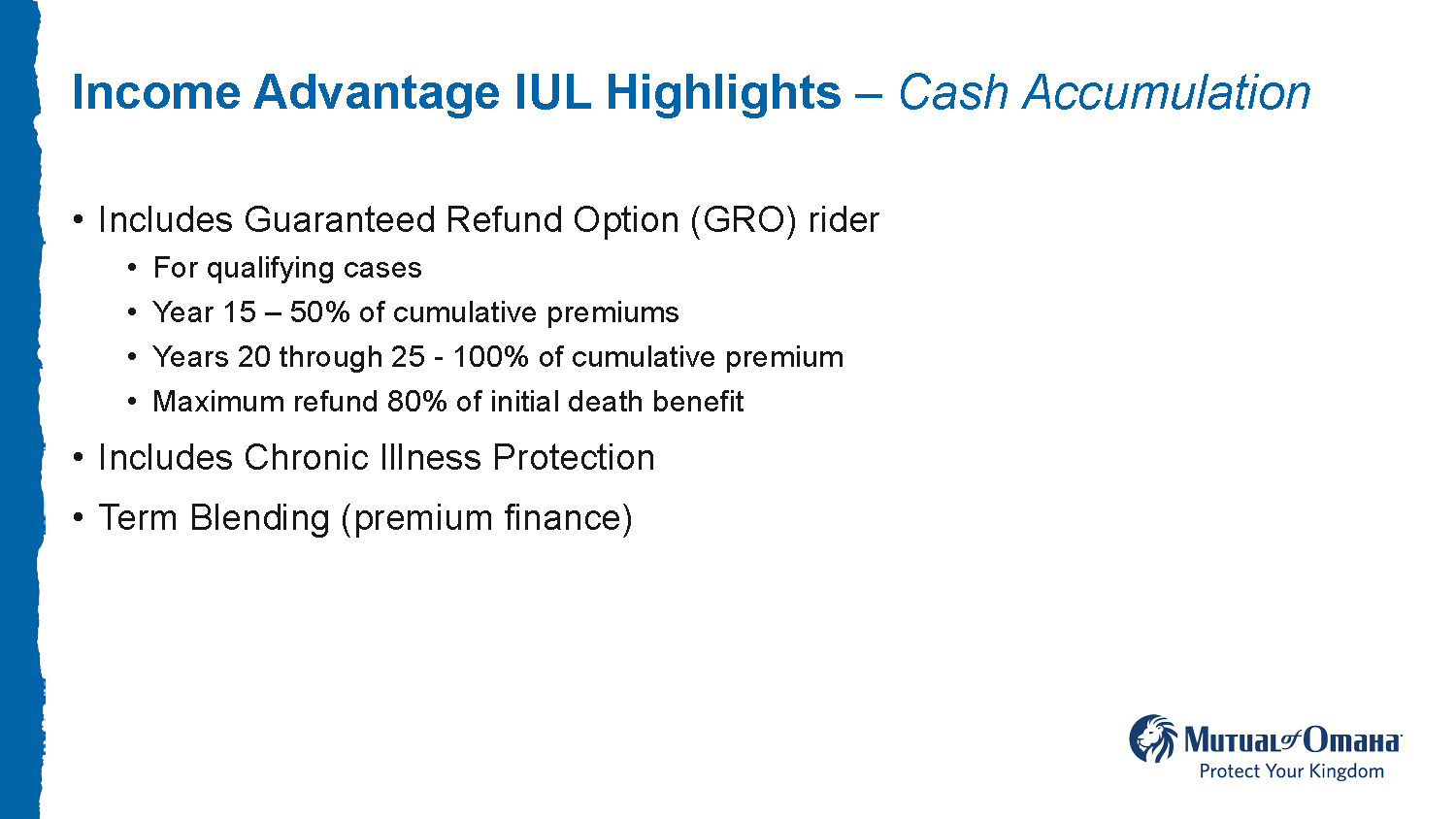

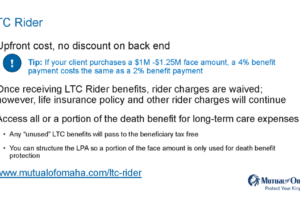

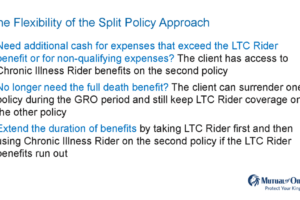

Reposition assets that are not needed during a client’s lifetime as premiums for life insurance. This strategy can allow clients to leave more wealth to heirs and could also protect against the financial impact of a long-term care event should you add an optional LTC Rider to the policy.

- Talk to High-Income Earners.

Changes in tax law occur. New and innovative products become available in the life insurance marketplace. Policy performance shifts due to market volatility or interest rates. These are all important reasons to conduct policy reviews.

Marketing Materials

Year-End Wrap Up: Life Insurance Trends of 2022

See who made the cut in our year-end wrap-up! We’ll summarize the top carriers in 2022, top products sold, what worked best in 2022, and the industry outlook for 2023.

Is Traditional Long-Term Care Still Relevant?

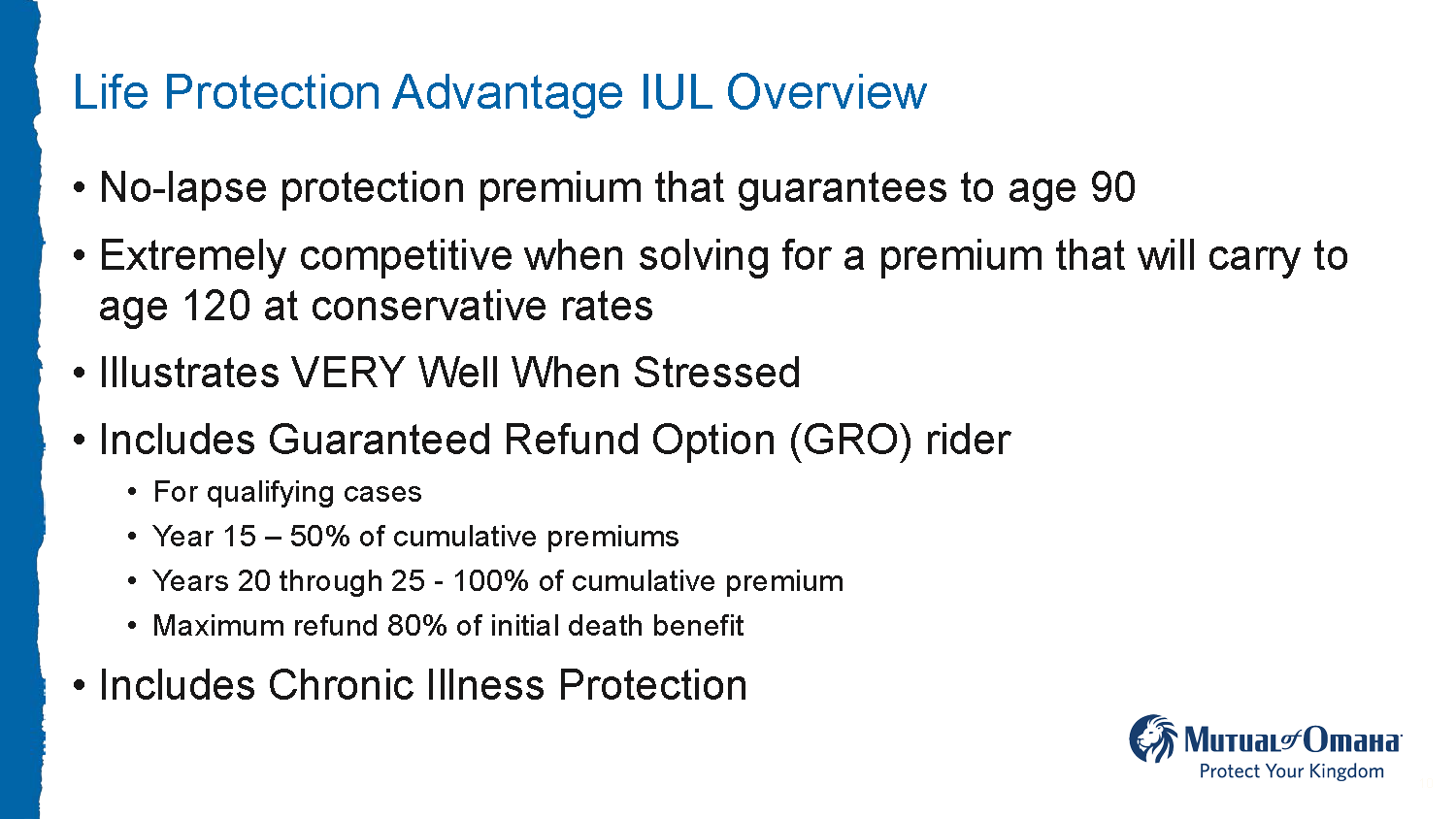

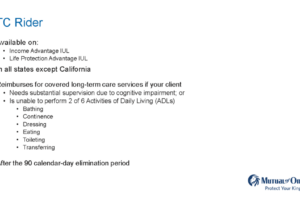

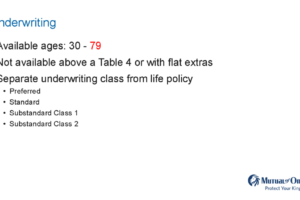

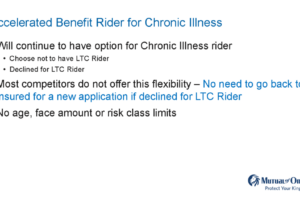

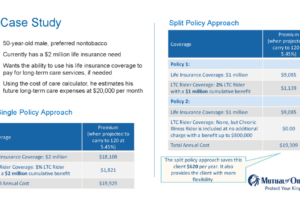

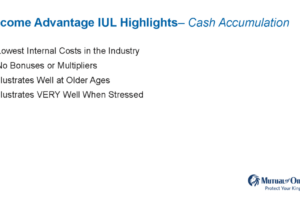

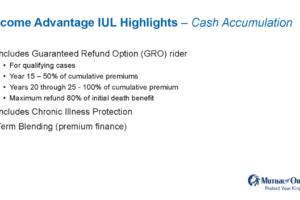

Mutual of Omaha, covers traditional long-term care insurance and where it fits in a field being taken over by hybrid asset-based products and long-term care/chronic illness life insurance riders.

Is the webinar quality low, or fuzzy? Change the quality to high definition by hovering over the video on the bottom right and changing the setting (gear icon) to 1080HD quality.